April 6, 2021

“I think we’re raising whole generations who regard facts as more or less optional … they’re being taught that it’s important to have views, and they’re not being taught that it’s important to know what you’re talking about.” –Thomas Sowell, famed economist, Stanford

First and foremost – Thank you!

All of you that donated to the Special Olympics Polar Bear swim in English Bay – where Michael Campbell (Moneytalks on CKNW 980) and I brazened the elements……a big, big THANK YOU! We had hoped to raise $10,000 and we actually managed to raise $29,000. Not possible without you!

Ok, ok, all the friendly (some nasty) comments on my lederhosen: I do NOT wear Lederhosen normally. My wife has threatened to withhold “services” (I think she means cooking) if I wear them around the house. So, I do not like Lederhosen, I’m not a Lederhosen kind of guy. Campbell made me do it!

However, to all those that wanted to know where to get them?

Amazon … get the Lederhosen without the Leder.

OZZIE THANKS YOU!

QUESTIONS, QUESTIONS – COMMENTS

FORECASTING IS NEVER EASY PARTICULARLY WHEN IT IS ABOUT THE FUTURE.

HOT AND HOTTER ECONOMY

THE NUMBERS, THE NUMBERS – MARCH 2021, 2020, 2019, 2018

FRASER VALLEY REAL ESTATE HITS TWO HISTORICAL HIGHS

SURREY SF PRICE IS UP 39%! BEST EVER !!!

BUYING A COMMERCIAL PROPERTY

INTEREST RATES HEADING UP OR NOT?

HOW EXACTLY WILL THEY STOP THE CRAZY MARKET?

PRE-SALES ROCKING AND ROLLING

BITCOIN, TESLA, CASHLESS

Q: The economy is getting hotter. What about the “solvency issues”?

A: Indeed, employment is soaring. Car sales are soaring. Real Estate is absolutely bananas. Texas rangers opened its whole stadium to 40,000. And we are getting the vaccine out. The “K” is working its magic. The top part is doing more than good, the bottom more than bad. We are muddling thru, but there will be rough patches. So far, the vast amount (unimaginable) of money both here and coming, helps all.

Q: David Rosenberg says we are in a huge real estate bubble. Harry Dent says the April crash is coming or he resigns(??). Garth Turner agrees. Do you?

A: Its not fair to make me comment on another forecaster.

Forecasting is never easy particularly when it is about the future.

Note:

- Mr. Dent wrote the “Depression of 2010” in 2009.

- Mr. Rosenberg (who I like) wrote

On Real Estate in 2017

https://financialpost.com/investing/david-rosenberg-make-no-mistake-the-toronto-real-estate-is-in-a-bubble-of-historic-proportions

On stocks in 2017

https://www.cnbc.com/2017/04/28/economist-david-rosenberg-a-day-of-reckoning-is-coming.html

I am sure you can find some quotes from me that were wrong (likely on higher interest rates which did not happen – but NEVER on higher real estate prices).

Q: The $20 billion crash in Viacom in 4 days smells of a total stock market crash. Where one guy can make a fortune and big banks suffer. The outcome? What say yeh?

A: I guess, I cannot get away from any and all questions. I keep saying, ask me about real estate… But, first it was a number of stocks, not just Viacom. Second, it did (seemingly) not affect the actual companies. Third the ‘one guy’ owns Archegos (Arch Egos?) a Mr. Bill Hwang ( I assume you mean) lost billions, fourth, it is one hell of a wake-up call for all of the players. Fifth, the SEC will step in.

A great Movie to watch is “Margin Call”. Yes, everyone likes “The Big Short”, but, in this movie…all the players knew what goes on all the time. The solution? Be first out!

Make wrong bets yes: But it is the first one out of the door…that wins. In this case Goldman and other big boys. The late comers took billions in losses. Credit Swiss over $5 billion etc. Finally – to your question: There is never just one cockroach.

Q: I worked in my store for 9 years. My store was bought. The new owner fired me the first day. No warning, no compensation. I have a son and single mother. What can I do?

A: This question was from ‘ask an expert’. Go see an Employment lawyer. You have rights. Do it soon.

Q: I see you make a lot of speeches on Zoom. How can I listen in?

A: The speeches that I make from Jurock Publishing or Land rush or Outlook conferences, tickets can be bought (next one September). Speeches I make on behalf of other companies (9 this month) are paid by those companies and no outsider can listen in. You can hire me though….Here.

Q: You talk about being DJ on Internet . I looked at Blip.com. Cannot find you. And 15,000 listeners, really?

A: Yes, I have been on blip.fm since 2009. But unfortunately, the “big boys” are taking over the ‘small boys’. You still can become a DJ – but listeners are way down, and the end may be near.

Become my new listener and I will follow you back…ha-ha.

Q: On your point of what could “governments do”… They could increase down payments!

A: Indeed. Canada could:

1. Increase down payments

2. Lower amortization times (from 25 to 20 years)

3. Raise stress tests

4. Bring in capital gains tax on all real estate: Hong Kong style … sell in 1st year – tax 50%, 2nd year 35%, 3rd year 15% etc.

Rest of the world?

New Zealand: Raises down payments for investment real estate to 40%!

As of May, most buyers who plan to live in their home will be required to provide a down payment of 20 per cent. Investors will need to put down 40 per cent.

China to slow lending: Larger state banks are required to limit their outstanding property lending and mortgages to 40 percent and 32.5 percent of their total loans.

China DP on first house 25% on second house 40%. In some areas that overheated its markets…DP are as much as 60%.

Funny, yet not really: Chinese authorities crack down on ‘fake’ divorces.

Since in some areas, second homes are not allowed some Chinese fake divorces to get to buy 2 properties!

Q: In the last 2 months 43 billion dollars left Hong Kong and came here. We need to stop the new wave from Asia coming. They are clearly to blame for our housing market.

A: What? Right now? No way, our market is on fire because of the most unreported inflation in hard assets OF ALL TIME! As is the whole world!

Read Ozbuzz 39 to 42. Or go to YouTube and see my clips from 12 years ago on this…or listen to every Landrush conference CD since 1998. It is not ‘Asians’, it is Canadians! Oh, and you just think this view is new: Look at this:

The new wave from Asia? This is the FNANCIAL POST from March 12, 1989. Nuff said.

Q: Not sure if you offer advice…….? But I would like to ask: I would like to buy my first piece of commercial real estate. It is an office/warehouse unit in … I would be extremely leveraged to make this work.

My question is: Do you feel the market is still a safe investment? The unit is listed for $1.1 and 2100sq 600 office and 1500 warehouse. Would a purchase like this continue to increase in value or is there a chance to lose $100,000? I am just scared. I do not want to let my wife down. Thank you for your time and consideration. R.

A: First. Ozbuzz is not about advice. We are just chatting, and I may or may not share my opinion on the world and things. Advice you need to take from your financial officers, bankers, realtors, and lawyers (see disclaimer below).

Also, I like commercial and industrial real estate. Rents cannot be frozen. I also like cashflow real estate best. But this kind of question is impossible to answer.

- You never buy the market. You buy a specific property in a specific area for a specific purpose.

- Warehouses maybe a good investment, but it may not have the 6-foot ramp (for delivery) it requires (in your area), maybe in a hard to get to place in the complex.

- You seem to want to put down $100,000 on a $1.1 million investment – hard to finance that scenario,

- You do not say what rental income, how long the tenant’s leases etc., etc. Is it a AAA tenant etc. Impossible question.

DO: have your realtor analyze all sales in the area, look at every listing, analyze income and expenses and see a real estate-oriented lawyer. If you worry abut your wife…involve her!

Q: I am buying a presale and get a mortgage. The broker wants a huge amount of information that in my view is not warranted. Can you help get a different broker?

A: Help with filling out your mortgage application? The broker only asks what the bank or financial institution wants of him/her. Right now, the requirements to get a mortgage are nuts! Just do it: This goes for everybody:

- Get your T4s and T1s for the last 2 years (at least) in order.

- Get your lease agreement or your purchase agreement including disclosure statements.

- Get your rental properties income and mortgage statements.

- Get your bank statements for 3 months (for down payment proof).

- Get a list from your broker (or go online and fill out forms of mortgage brokers…to understand all you need and why).

We may have low interest rates but qualifying is harder than ever…and will get worse.

Q: How will they stop the crazy market?

A: Several questions on this. Look below and then read OzBuzz 56 online at ozbuzz.ca.

Q: You see big inflation ahead. You see it worldwide. If there is big inflation I should borrow?

A: Yes. Big time… After we get through the spring / maybe summer. In my Inner Circle … we spend a lot of time getting ready.

Q: With March, April and May seeing big slowdowns in sales last year, this year will look soooooo much better, but it will create a false sense of what really happened.

A: Indeed. Plus, also we have permanent changes coming. A lot of businesses have invested in technologies that have long been available, but there was no need to do it just then. Maybe we were all in a bit of a rut. The pandemic has forced all of us (personal and business) to change. There is no going back to the old normal. New technologies change not only companies or individuals… but the whole way we know employment. I always quote Mike Vance: “Innovation is the creation of the new or the re-arranging of the old in a new way”.

Ask yourself: What can you re-arrange in your business or your life?

Q: Did you see CMHC was found not to have told the truth on this! By the Taxpayers Federation! They DID commission the study and then lied about it!

A: We did a show on it on the Michael Campbell show last Saturday (CKNW. 980 8:30 -10 am every Saturday) Read more here: https://www.blacklocks.ca/cmhc-lied-on-housing-tax/

Q: Your items on taxes. My husband and I agree. Do you think the tax-free homeowner capital gain exemption will be part of this budget on April 19?

A: No, not retroactively – not with an election pending. But something similar may be brought in. Likely the taxation of future gains. Also, go here to see my video from last July…where we forecast this: https://www.youtube.com/watch?v=8W-Q3-ewAyM&t=400s

Q: On presales you say it is mad. But is your company not selling them?

A: Yes, the market is mad in demand. People are running into hard assets, Jurock Case investment Realty handles some presales from time to time. Usually only those we invest in ourselves and where we like the developer. And yes, we invite newcomers. We do not have salespeople, but you can go to JCIR.ca for info – if interested. Next one? Low and Highrise in Surrey…

Comments:

- Lots of comments on assignments. Remember: Developers do not want to compete with themselves. Problems? Go see the developer. I see a future where assignments will not be easy.

- Bitcoin. Your comments just will not go away. Dr. Burry, Roubini, Dalio…all forecast a government takeover – bubbles.

Me…as Manuel said: I know nothing…I do not understand Tesla, Bitcoin, or other crazy market excesses. I DO know, a Black Swan will appear. Note: Bubbles have imputed value not intrinsic value. This much stimulus will lead to severe problems!

Q: On bond rates you said: If the 10-year rate hits 2% – be very, very careful. What do I need to be careful about?

A: Interest rates 1: The government inflation target is supposedly 2%. Note that this 2% target is really much lower than the ‘real‘ rate since the ‘basket of goods and services’ they use to arrive at their 2%, is not complete. It does not include a whole bale of stuff (rents, little real estate, oil etc., etc.). If the official rate goes over 2%, the 10-year rate will go much higher in ANTICIPATION. Bond holders will at least want their money back (As of this April bond holders from last summers are in serious loss territory already). If it goes higher and fast — HIGHER INTEREST RATES WILL RESULT…no matter what the Fed or anyone else says. Bonds can be issued but they must be bought…In a ‘high inflation world’ bond buyers will stop buying until rates are (much) higher. That is where that comment comes from. Oh, and long-term mortgage rates are tied to the bond market, not the prime rate.

Ok Interest rates 2: Just looking at today’s outcome: We will have Monetary hyper inflation or rates must rise! You tell me what we have now when House prices are up 39%!

Q: Your item on annoying “promotions” and your readers answer is not working. They keep changing the ad anyhow – even if you do not open it.

A: You are right, I noticed it too. Only thing is just do not open it…And do not buy their stuff.

COMMENTS

Again: If you are in the industry, in building, selling, marketing, developing lawyering, etc…,etc. list yourself in the FREE BC REAL ESTATE DIRECTORY: WWW.BCRED.CA

HERE IS WHERE OZZIE RANTS (A BIT)

- I have at Ozbuzz.ca (jurock.com) some 24,000 signed up subscribers… I have a totality of over 28,000.

- I have turned my model to totally free.

- I have miniscule negative comment.

Yet

Yet

Wait for it:

I have just 1,154 subscribers to my youtube.com/jurockvideo channel.

My Rant: We have over 20 years huge number of views…but no one pushes the subscribe button!

It’s free, it’s like a “like” on Facebook….Come on…Give me a boost.

THE NUMBERS, THE NUMBERS IN CANADA

HPI Benchmark prices for FEBRUARY from CREA

Summary:

- National home sales rose 6.6% on a month-over-month (m-o-m) basis in February.

- Actual (not seasonally adjusted) activity was up 39.2% year-over-year (y-o-y).

- The number of newly listed properties rebounded by 15.7% from January to February.

- The MLS® Home Price Index (HPI) jumped 3.3% m-o-m and was up 17.3% y-o-y.

- The actual (not seasonally adjusted) national average sale price posted a 25% y-o-y gain in February.

THE NUMBERS, THE NUMBERS

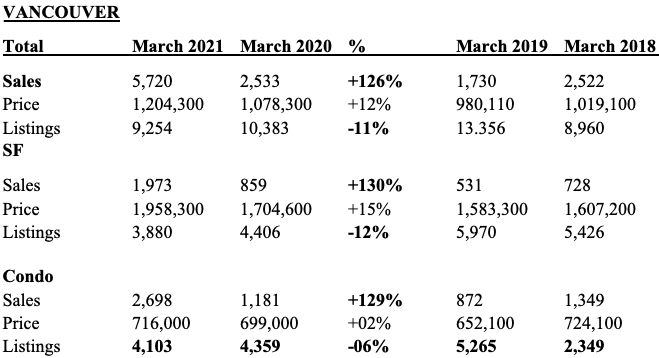

VANCOUVER AND FRASER VALLEY/SURREY MARCH 2021, 2020, 2019 and 2,018

NOTE: As we hinted last month, these numbers are still relevant as March 2020 clocked in substantially higher than March 2019. Also, this month clocked in double of the months of March in 2019 and 2018! But from ‘hereon in’ COVID 19 crashed sales until the summer last year. So, comparisons will be less relevant in coming months.

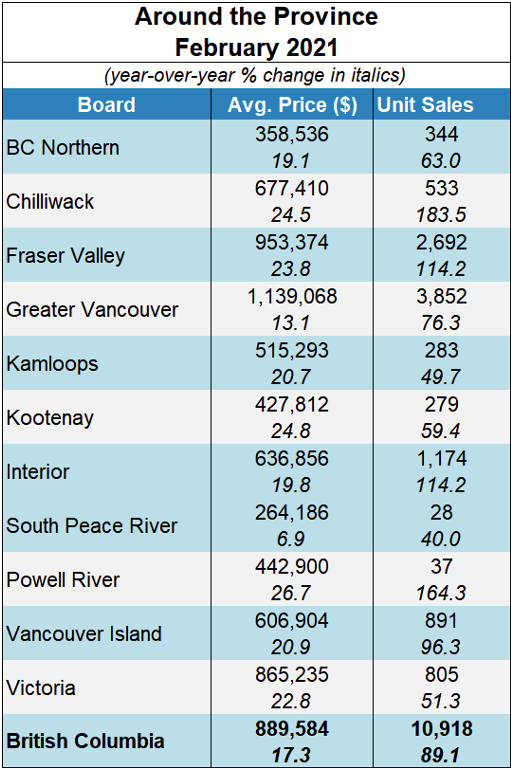

BC – FEBRUARY – BCREA: A BOOMING PROVINCE…booming!

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 5,708 in March 2021, a 126.1 per cent increase from the 2,524 sales recorded in March 2020, and a 53.2 per cent increase from the 3,727 homes sold in February 2021.

Last month’s sales were 72.2 per cent above the 10-year March sales average and is the highest monthly sales total ever recorded in the region.

Major Point: We are running out of descriptions. Crazy market, record sales…etc., etc. But SF home sales are up a whopping 130%, condo sales up 129%. SF home prices up a roaring 15%! Listings down 11% (Much lower than the -28% of last month on the SF home side.)

Condo listings down by 6% but Vancouver condo prices only marginally HIGHER AT +2%? Well, they are still higher than last year … but now only by 2%.

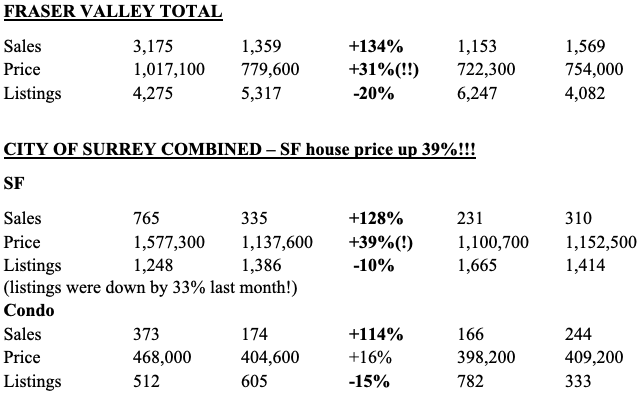

THE FRASER VALLEY

Fraser Valley real estate hit two historical highs in March, setting records for both sales and new listings processed in one month since FVREB inception in 1921. In March, the FVREB processed 3,329 residential and commercial sales, an increase of 131 per cent compared to March 2020 and 18 per cent more than were processed in February. The previous record of 3,006 sales was set in March of 2016.

Fraser Valley sales in total? UP 134%! Prices? +31%! Active listings? -20%!

The whole Fraser Valley market has gone ‘up, up and away’. As we predicted…values grow where people go, and people go where the jobs are…like in Surrey.

Major Point: SF sales up 128% and condos up 114%!!! Prices up for SF??? UP 39%!!! Prices up for condos?? UP 16%!!!

This is the area where Jurock Case Investment Realty is delivering 50 condo new homes that were sold 2 years ago? Oh, happy times!! Also, Whalley is the area where we are helping to launch a new pre-sale building this month. For info: oz@jurock.com

Finally:

The Okanagan shows lot sales up 563%, condo sales up 193%, SF homes sales up 136% and prices? Up across the board 26 – 28%.

LIVE LIFE LARGE

Look after your body.

If you do not

Where are you going to live?

I eat for vitality, longevity, and health.

I work an exercise program designed

for energy, stamina, and strength

I can and will do my program.

I will grow into my future best.

LAST CHANCE: Did you miss LANDRUSH 2021?

REAL ESTATE OUTLOOK CONFERENCE IN 28 YEARS

OR – EVER is now on video!

https://jurock.com/product/land-rush-2020-2021-video/

12 Ace speakers share their forecasts

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment