“For me the most important thing is to know how much risk I’m taking … not how much money I can make. We are in a new world right now. I don’t know how to calculate reasonable risk levels in this new world so I’ll wait until I have some confidence that I can do that … then I’ll take positions.”

March 24, 2020

- QUESTIONS, QUESTIONS

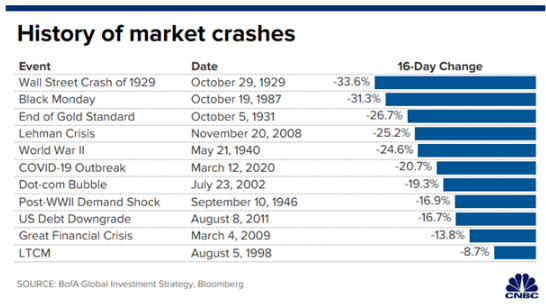

- PAST STOCK CRASH HIGHS

- PAST STOCK CRASH RECOVERY TIMES

- VIRUS TIMELINES

- OTHER PANDEMIC OUTCOMES

- THINGS WE MUST (OUGHT TO) DO

- CONVERT TO CLOSED VARIABLE NOW

- MOTHER OF ALL QE MEANS – INFLATION

- GOVERNMENT HELP SITES

- BINGE NETFLIX … SHOWS

QUESTIONS, QUESTIONS

Q: I have followed you for 40 years. You believe that creating more money by Government results in more inflation. This time too?

A: Hey, NOT 40 years. I started writing my newsletter in March 1993. And the answer is yes, eventually. See below.

Q: Your advice at The World Outlook conference, to have 50% of your money in cash was most timely. I never did make it to 50% but was able to get down to 25% cash. Unbelievably, that’s now the most that’s left over from my portfolio. Of the rest I lost half.

A: I assume you were in Energy stocks in total. The losses elsewhere were not as outrageous. and hey, I say if you are over 70…50% cash. Lower age groups I recommended lower percentages. Cash is not Trash.

Q: I have received 67 questions on the stock market, the world…etc., etc. I think must have been answered by my main theme above. For people that want to hire me, thank you I am flattered, but I am enjoying my life, just the way it is.

2020 – WHAT A WORLD WE LIVE IN

First, the worldwide crisis of climate change

Second, the railway blockades

Third, the oil war and oil crash

Fourth, the stock market crash

And now Coronavirus….

Time to head for the hills? Real Estate markets are poised to tank? We are all going to die?

STOP IT!

We have been there before, and we have had worse! Worse crashes in stocks, worse crashes in oil, and worse pandemics. Each time we are in a deep crisis, some of us panic, some jump out of the window, some cry, some blame leaders … but mostly, the world goes on, we go on, we adapt … somehow, we muddle through. No matter how bad the crisis … we survive.

In the past, in the middle of darkness, we reviewed and recommitted ourselves to our principles; we studied our responses. We thoughtfully took action and we refused to cow under … to any circumstance – no matter how many cried: “It’s over, it’s different this time.”

Today, clearly times are tough. One can argue that governments are overreacting, (Heal the virus – crash the world economies. Heal the virus – create unconscionable debt loads – keep people at home – crash retail properties. Heal the virus – crash employment as we know it.)

Actually, the more ‘solutions’ we come up with, the longer it will likely take to get thru it! To work it out, to go down the odd blind alley. But there is no doubt in my mind that:

GETTING THROUGH IT WE WILL!

But to survive any crisis, you must understand the environment you are in and take appropriate action – MOSTLY, go your own road.

THINGS WE MUST DO:

- Stiff upper lip…no excuses, no whining, we will survive.

- Control your panic – do what you can – repeat positive messages … constantly!

- Consciously keep your spirits up – people can smell how you feel in your voice, your bearing. Work on yourself, stand while talking on the phone, have a positive message right by your phone:

- an outline on why real estate will recover

- why it is good to buy/sell now

- and yes, keep other spirits up too like – wine

- support your government, not your party

- On the virus: listen and keep social distance, follow all the advice given

- On stock crashes? look at previous crashes below

- On stock performance after previous big crashes: look below

- On government actions: watch the news, listen! understand … what is being said and what is being done. The FED and Canada are all in. ALL IN!

Then – take a deep breath and read OzBuzz 39 (at ozbuzz.ca). In it (and for 27 years) I explain what happens (in my view) when we create money out of thin air. After any past crisis hard assets like real estate RISE almost in direct proportion of the mad money creation. Today we create more money than EVER!

If you are concerned about the economic crises (deflation) and the asset crises (real estate inflation) read 39, 40, 41, 42 – INFLATION/DEFLATION, TREND, DEMAND AND SUPPLY, CYCLES. ozbuzz.ca

Then measure what you hear and see against past crises. They seemed just as bad; some were actually very bad … yet here you are today. What do the news tell you? We are printing money, we are lowering bank reserve requirements, we have zero interest rates – all that means? QE is back. In fact, the mother of all QEs. More than all other QEs together! It means INFLATION (of hard assets).

Today we are creating more money than at any other time in history… Well researched, well selected real estate (all hard assets) benefits inflation … not today, maybe not this year … but there will be a deal of a lifetime … for the action takers. Deals? It’s your call … but there will be deals in…

- well selected stocks, b) in oil and c) well selected (stink bids necessary) deals of a lifetime in real estate.

Major Point:

Finally: In 1987 at that famous crash I ran a real estate company with 10,000 employees and was advised by the best economists in the world that we were going into a depression. Based on that, I laid of 1,000 people, that – in retrospect – I did not need to lay off, as the crisis was over in 7 months. In fact, the crisis helped real estate in that pension funds increased their real estate holdings.

In the early nineties the Savings and Loan crisis was supposed to sink banking and all normal bank transactions. A special trust was formed that forced banks to dispose all non-core assets. I bought a 3,000-man strong real estate company from that trust (Resolution Trust) for a song.

In 2009 and 2010 I was on the radio every week telling people to buy the USA and my investors and I bought hundreds of units in Phoenix for a song.

In the middle of each crisis, fear grabs us by the throat, the naysayers seem ‘oh, so right’ and yet … I am with Warren Buffet: “when everyone is crying you should be buying”.

Of course, Mr. Buffet also has principles that he guides himself and his company by. Well researched companies, a plan of action, a time horizon, not a gamble. So, should we real estate investors.

It very much applies to us in real estate as well. Not all real estate is good (hotels, quarter share, timeshare etc.,) but well researched, well selected and well bid real estate has weathered ALL crisis and did so WORLDWIDE.

Today, things look dark, but they did look dark throughout history … each time … too! The chart below stops at 2001. Since then we had a major crisis in the Savings and Loan crisis, the subprime mortgage crisis, the US real estate market collapse crisis (2009-2011), the major stock crash of 2008, the major economic crisis of 2008 and 2009, the ‘tax and stress test crisis of 2016/2017. And so on.

OK, Ozzie, I hear you. but this is a health crisis, with thousands of possible deaths. This is different. Yes, indeed, yet we have been there before also…

We could go back to the pest, the black plague or added the hundreds of pandemics of previous centuries. Yet, only since 1918 had we these major ones (there were 22 more smaller ones).

We had

1918 H1N1 Pandemic (50 million deaths worldwide, 75,000 in the US)

1930 – till now – History of FLU Pandemic – (Every year over 50,000 deaths)

1957-1958 H2N2 Virus (1.1 million deaths globally, with about 116,000 in the U.S.)

1970 Swine Flu

1968 H3N2 Pandemic

2009 H1N1 Pandemic

(Then there were SARS, EBOLA)

I know it is not the same, but remember: The flu has sickened 36 million Americans since September and killed an estimated 22,000, according to the CDC, but those deaths are largely unreported.

It is also clear that China (Wuhan) had a massive event for 3 weeks. It peaked and now they only have cases originating from outside. If the US and Canada follow that pattern, we could be peaking first week in April, then go down and we could be out of this much sooner than anyone is predicting. Our RELENTLESS media IS causing panic by CONSTANTLY REPORTING new number of cases and quoting this or that ‘expert’ – for the end of the world.

When we in NA focus on a problem we will solve it. The head of the Ebola crisis solver is running this crisis fight now, The FED and to a lesser degree Canada went ALL IN by throwing every last available dollar into the mix

Major, Major Point:

Of course, I am concerned, and so much more could be said. Points: We have immense demand destruction and our future is a kaleidoscope of possibilities, both up and down. The nature of the news is very confusing, we have peak uncertainty. In fact, anyone that tells you with absolute certainty what is going to happen next week – run! No one knows! Ask me what will happen in 2 or 3 years. I remain certain that real estate and out world will be just fine.

In our Real Estate Action Group meeting, I will discuss/recommend action on the multitude of things that will face owners:

Mortgage payment deferrals, no evictions, rising (yes, rising) interest rates, closing pre-sales and much, much more…

I did not say it was easy, I said it was manageable. I bet on optimism. We will come out all right!

Ozzie

MORE STUFF TO DO

While I am at, forget the virus for a minute:

- YOU MUST change your open variable rate to a closed variable rate. NOW!

URGENT! Your open variable is a demand loan! In this (liquidity crisis) environment you do not want a loan that MUST be paid back on call. This loan also has a provision that could make you pay 3% of the loan monthly on call! Closed variable means they can’t call the loan!

- Expect your HELOC to rise maybe to prime plus 1… even if the BOC drops a rate

- If you are about to be laid off, refinance NOW. You will not be approved if you have no job!

- Even if sales are down expect a long wait … since refinance is booming! Get yourself ready: Ask your broker, what docs he needs. Ask now, get ready, apply. Expect still 14 days for approval. If you don’t have docs ready wait 4 weeks.

WHAT OF CANADIAN GOVERNMENT HELP?

The BC Government has just announced some support services for people and businesses affected by the Covid-19 pandemic. Click on the following link for more information

https://news.gov.bc.ca/factsheets/bc-takes-steps-to-support-people-businesses-during-covid-19-pandemic

Federal Government

https://www.canada.ca/en/department-finance/news/2020/03/canadas-covid-19-economic-response-plan-support-for-canadians-and-businesses.html

EYEBROW RAISER

- The ‘bidet’ is now the best replacement for toilet paper. It is actually better (ha-ha). And you can get a portable one too. And it is – oh so nice.

- The divorce rate shot up in Wuhan after people were let out of their houses. So, my dear isolated ones – be nice to your beloved…

- Credit card rates are still in 25% to 28% range. Ludicrous. Here we are a) in a prime rate below historic levels, b) in a world where everyone’s credit cards will be maxed out!!

GET THOSE RATES DOWN. (Next week mortgage Ace Dustan Woodhouse will explain why)

BOOK OF THE WEEK

Ace Realtor Rick Hoogendoorn from Victoria recommends, and I concur: ‘Tiny Habits’ by BJ Fogg. This book, along with James Clear’s book ‘Atomic Habits’, would be great to delve into now. Create new habits and practices so you come out of this “lockdown” in better shape in some ways. Says Rick: “I’m reading both and practicing with the help of both.”

Ace Realtor Rick Hoogendoorn from Victoria recommends, and I concur: ‘Tiny Habits’ by BJ Fogg. This book, along with James Clear’s book ‘Atomic Habits’, would be great to delve into now. Create new habits and practices so you come out of this “lockdown” in better shape in some ways. Says Rick: “I’m reading both and practicing with the help of both.”BINGE WATCHING SHOWS

The Crown: superb (Historic drama – most expensive Netflix drama ever)

Bodyguard: short series – but oh so great!

Mindhunter: start of FBI Altered Carbon – Science Fiction

Stranger Things (SF)

Black Mirror

Breaking Bad (classic)

The West Wing (classic)

DUMB THINGS PEOPLE SAY

- Patience is a virtue. Brrr. When I was in charge of a very large corporation, I was known to be ‘impatient’. It implies you want to get things done. Calling patience, a virtue means you get run over.

- Employee Meetings are the backbone of good communication. Brrr. Never, ever. Most are boring, predictably long and unnecessary. Only have taskforce sessions. A clear objective for the taskforce and a deadline for achieving the task goal before you leave. At this forced social distancing, we will now realize how little we really need these meetings!

LIVE LIFE LARGE

You can have everything you want

but do you want everything you have?

I am grateful for what I have

I am thankful for my friends

I am thankful for abundance

I will share what I do not need

Things are things – joy is joy

I will grow into my future best!

Look up all the

“Grow into your future best” cards at: www.commitperformmeasure.com

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment