February 13, 2020

- HOT PROPERTIES – RESORT – SINATRA STAYED HERE! PRESALES WILLING TO WALK FROM DEPOSIT! PEMBERTON PENTHOUSE! EDMONTON OWNER WILL CARRY MORTGAGE WITH 10% DOWN.

- THE NUMBERS, THE NUMBERS

- OZZIE EXPANDS ON HIS ‘TREND PRINCIPLE’: WHY I ALWAYS BUY WELL SELECTED CASH FLOW REAL ESTATE

- QUESTIONS, QUESTIONS

- WORLD OUTLOOK CONFERENCE REDUX

- CONDO INSURANCE DEBACLE MAY SERIOUSLY AFFECT THE MARKET

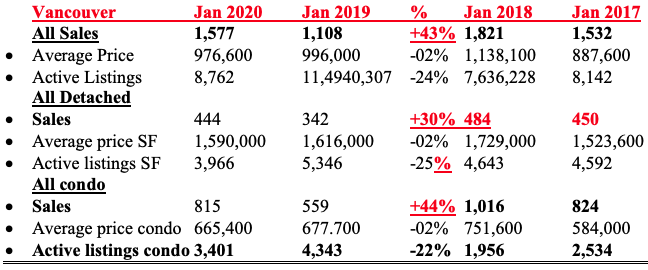

THE NUMBERS, THE NUMBERS – VANCOUVER

Major Point: I report sales for last 4 years – look at them … prices are down by 2% (a tad) over last year but up on both SF and condo sectors. Again: Not just a flash in the pan. Sales are up, listings are down. Again: The next 2 months (Feb/ March) bear close watching.

Anecdotally we hear that February is roaring in Vancouver.

QUESTIONS, QUESTIONS

Q: I can’t believe that the city will bring in vacancy control. Who would want to be a landlord?

A: Indeed. Quite a few comments on this at the conference as well. It’s like selling hamburgers at $5 each. The ‘fictional’ city says that’s the base price – cannot be raised from $5. In the meantime, you face cost increases on the meat, minimum wages, the vegetables, the buns, the rent and/or taxes etc. etc. Result? You stop making hamburgers … you shut down.

Q: The insurance debacle, can you talk about it?

A: Yes, see below.

Comments: I really liked your Ozcast (ozbuzz.ca) with Michael Geller. The man knows what he is talking about.

Congrats on your work anniversary Ozzie … I am hooked to your real estate ideology since 1992.

WORLD OUTLOOK CONFERENCE TIDBITS

After I took furious notes, saw most every speaker, this is what I learned:

- US dollar will go down (Schachter), US dollar will rise (Armstrong).

- Canadian dollar up and down (but mostly down)

- Oil will see no more than $60 but $45 first or of course we could see $80.

- Interest rates will be higher and lower.

You get the point. Opposing views. Needless to say, every speaker has an opinion and here were some of the world’s best giving us theirs. Of interest to me:

- In a collapse, you can’t buy food with your bitcoin.

- Countries like Thailand, Australia, China cut their rates, so their currencies are devaluing (Thai Baht 3 times) to stay competitive (I wrote about this at length in OzBuzz 9)

- Liquidity will be the issue (again)

- Most presenters expect a serious reversal this year. “abrupt moves are a possibility”

- Don’t buy anything (in the markets) that you can’t get out of fast.

For myself? My speech essentially was to stay the course (real estate is the hard asset of choice), darn the naysayers … we have been there before…

Go get the whole show on video on sale here: https://mikesmoneytalks.ca/world-outlook-conference-2020/

PRINCIPLES – Continued from OzBuzz 39 and 40

Macro:

In OzBuzz 39 we covered the question on “inflation or deflation”. In OzBuzz 40 we tackled “timing” …today…

Follow the TREND.

This next principle is just as important. More people moved into Surrey (1,200 a month now in 2019) in the 90s than all of the people moving into Eastern Canada (sans Ontario) … thus building lots went from $60,000 to $120,000 in Surrey at the same time as the fine waterfront condos in False Creek in a magnificent location crashed.

Major Point 1: In 2016, 2017, people left Alberta and Saskatchewan because of a loss of jobs and headed back to BC. In 2019 that trend reversed and there is a net outflow back to Alberta. In our various articles on Penturbia in the 80s and 90s we pointed out that people were heading to small towns and the countryside. We asked you to invest in those small towns. After a few years the trend changed… People wanted to see the cows, not smell them. And then they missed the action in the city. “Where is my sushi?”, they cried.

Major Point 2: Ask, what is the trend in the general area I want to invest in? What is the major employer doing, expanding? Are people moving out of town or back into the city?

Also, IMPORTANT. Look at the new trends: Millennials will rent in town; they can do without cars. Online shopping increases the values of intown storage/warehouses for overnight delivery. Huge group of foreign students will maximum rents, environmental waste disposal property owner will become zillionaires. Movie making increases the value of unique properties and large spaces for rent. Re-visit our “new world” items in OzBuzz 36: 4-day week, cashless society, 3D printing, all are new trends that spell out opportunity. Of course, the reverse is true. Online shipping kills retail locations (stay away from buying retail, etc.).

But you get the point: Figure out the stage of inflation in hard assets, find out the timing and the trend and invest with confidence (and of course: Leverage).

What are millennials buying, where are older people retiring? The trend of moving back into the city, etc. Look at our recommendation – maybe the new trend of buying/rezoning accommodation for foreign students or warehouses for movie producers suits your profile?

SOARING INSURANCE INCREASES ARE THE BLACK SWAN OF THE CONDO MARKET!?

Tony Gioventu, executive director of the Condominium and Homeowners Association of B.C. says that some insurance companies are pulling out of B.C.’s real estate market, and they’ve struggled to keep up with claims from global disasters. But he is deeply concerned about the effect if – as reported – some buildings may not be able to get insurance at all. In fact, Gioventu says he knows of a handful of buildings currently unable to get insurance and said there could be more out there.

He is right of course. If this is not dealt with, buyers will be helpless to close on a mortgage (with no insurance they lose their deal). Banks will not finance uninsured buildings and that’s what is happening to – some – BC buildings. The THREAT: Owners are now at risk if disaster strikes; their banks could pull their financing and they will be unable to sell their properties.

In the meantime, premiums are soaring. CTV reports that the strata president of one Burnaby condo told them their annual insurance premium has quadrupled, from $200,000 a year to $810,000, and they can no longer afford to pay it.

Higher deductibles will result in massive increases in maintenance fees or special assessments.

“This is not a small number of buildings now. We’re now looking at several hundred buildings throughout the Lower Mainland that are seeing such dramatic increases,” said Gioventu.

The buildings that are being hardest hit are those that are the most expensive: buildings with a high number of recent claims and strata corporations that have failed to keep up with maintenance and repairs.

Major Point: This can be solved only through legislation. As an owner you – UNLESS YOU SCREAM AND FIGHT the problem could become unmanageable and may sink the condo market.

HOT PROPERTIES

- Pemberton penthouse. 2 BR, 1 Bath, walking distance to downtown. Underground parking, in-suite laundry. Price: $429,000 (includes GST). Can rent for $2000+ per month.

- Quesnel Lake. Likely, BC. Former Resort now used as private family retreat. Big Lakefront building with 4000 sq. ft. several guest cabins for entertaining. This 4.2- acre is split into 2 titles and includes a small island. Lots of history on this place. It has hosted Clark Gable and Frank Sinatra. Reduced to $649,000.

- Langley. Buyers cannot close! 4 brand new presales in Langley that are closing in 1-2 months. Investors who put deposits down of 5-10%. They are willing to leave their deposit money in, if they can get qualifying partners who can close. They are different buyers. Prices range from $435,000-$512,000

- Surrey, commercial strata unit, 765 sq. ft. Commercial office/medical space. Price: $450,000. 5% expected cap rate in 1-year old building.

- Edmonton. Vendor will carry financing with 10-15% down. 2008 built 1500SF Home in Edmonton in new subdivision. Below assessment. Estate sale, foreclosure. Price: $350,000

OZZIE “OLD BOOKS OF THE WEEK”

- A Course in Miracles – A Gift for all Mankind, Tara Singh

- A Visionary Life, Marc Allen

- As a Man Thinketh, James Allen

- Awaken the Giant Within, Tony Robbins

- Brain Power, Albrecht

- Care of the Soul, Thomas Moore

- Die Broke, Stephen Pollan and Mark Levine

- Doing it Now, Edwin Bliss

- Emotional Intelligence, Daniel Coleman

- First Things First, Stephen Covey

- Focus, Al Ries

- Forget About Location, Location, Location, Ozzie Jurock

LIVE LIFE LARGE

Procrastination is a subconscious desire not to do something

Procrastination deceives oneself

I do what I say

I will do, what I commit to do

I under promise and over deliver!

Look up all the

“Grow into your future best” cards at: www.commitperformmeasure.com

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment