January 9, 2021

“The difference between successful people and really successful people is that really successful people say no to almost everything.” –Warren Buffet

QUESTIONS, QUESTIONS – COMMENTS

NEW PODCASTS

NEW VIDEOS

WHY CANADA IS THE BEST PLACE – EVER!

THE NUMBERS, THE NUMBERS – DECEMBER AND YEAR TO DATE|

VANCOUVER – CALGARY-EDMONTON-SURREY-VICTORIA-TORONTO

BITCOIN – QUESTIONS TO ASK

INTEREST RATES

WHERE TO GET A 20-YEAR MORTGAGE AT ‘0’ PERCENT

BIDEN TOTAL WIN IS GOOD FOR STIMULUS PACKAGE COMING FASTER

SOLVENCY ISSUE – OR NOT?

BINGEWORTHY SHOWS – NEW BOOK RECOMMENDATIONS

Ozzie’s latest YouTube videos

- Ace Day Trader and author of the Trading Deck Victor Adair shares market secrets, Gold, Currencies, Stocks. Forecast 2021 https://www.youtube.com/watch?v=xt6ApBhitnA

- Save on Taxes with the Smith Manoeuvre. Robinson Smith explains how you can make your home mortgage tax deductible… As well how to take years off your mortgage term – just by re-arranging your set-up. See him at: https://www.youtube.com/watch?v=2QUf1WD6Coo

No time to watch videos? Well, listen to the video/OzCasts on Ozzie’s podcast here:

- Ozzie with Victor Adair: https://jurock.com/2020/12/21/oz-buzz-podcast-31-ozzie-jurock-in-conversation-with-stock-market-ace-victor-adair/

- Ozzie with Robinson Smith: https://jurock.com/2021/01/08/the-smith-manoeuvre-will-reduce-your-taxes-make-interest-deductible-take-years-of-your-mortgage/

Watch next week for 2021 forecasts on Condo sales, The real estate markets, Gold forecasts.

RESOLUTELY SUCCESSFUL IN 2021

At the end of every year, as I (and most of you) reflect on the year just passed, I am reminded that no matter what happened throughout it was ALWAYS more turmoil than we expected. We ALWAYS had to defend real estate investment, we ALWAYS combatted the naysayers…and at the end…we had another fine year of investment, of personal growth. Yet, at this end of 2020 I am left with eyebrow raising debacles:

Whither the new year? Wither the virus? Wither solvency crisis? Disaster, turmoil, changes? But in the end, the economic crisis, the attack on the World Trade center…all were major disasters too. So, eyebrow raising and wondering…Yes. But also, a new start, a new beginning with real estate investing more important than ever.

So, time for a new New Year’s Resolution?

Last year we asked:

Did you make your New Year’s resolution for the whole year or the usual ‘24-hour New Year’s resolutions madness?’

We also pointed out that:

‘Don’t let the past determine your future.

Just because resolutions of the past didn’t work has absolutely nothing to do with today’s resolution.’

Yeah, yeah, you say, the good old ‘today is the first day of the rest of my life’ saying … well, YES, IT IS!

Your past in NO WAY determines your future. YOU DO!

In my view, we will have a unique, scary, but also opportunity-rich 2021. YES! In 1998 when the NDP was in power and the average price in Vancouver was $278,000, the negatives abounded. The market had gone down by 18% (from $350,000) outlook was poor etc. So, I wrote my now famous “BC is full of Yeah-Butters’. No matter what positive outcome one attempts to mention, someone blurts “yeah but”.

In my major, major points, (Monthly Newsletter from 1993 to 2010 every month) I repeated and reflected on the upheavals and the negative forecasts EVERY YEAR for 26 years. And before that as president of major real estate corporations…every year speeches had to tackle the previous year’s debacles. I did, reflected, analyzed and then told you to buy.

In 2004, the market was reversing, and I found myself once again writing to you, my dear subscribers and after I reflected on all the negatives, I concluded, that we in BC are nuts. Not just we – in BC. All of us in Canada!

I wrote (and repeated it often since) that “We live, play, breathe in paradise. In fact, we should revel living in Canada. The rest of the world thinks being allowed to be here is close to having our ‘Heaven on Earth’. They admire our incredibly special and unique Canadian spices.

Think about it:

The environment is majestic, the climate outstanding, and the views spectacular. There is a very crisp flavour in Canada. Call it the fine mountain air or ocean spray, balmy sunsets, beach-roses in February and asters in October. Part of it is that special Canadian blend – an entrepreneurial, innovative flavour, a generosity of spirit, of open arms, an embracing of life in the outdoors and life where every individual can grow into his or her own FUTURE BEST SELF.

‘Experience is not what happens to a man. It is what a man does with what happens to him.’ -Aldous Huxley

Apart from all the economic gobbledygook, weird election politics (amazingly that was true in 2004 too) and – darn it – the virus – the reality is that this is the best place in the world to be. We can with confidence believe in the long-term, strong, viable, positive, and indeed bright future for Canada despite its UPS AND DOWNS. People from all parts of the world are waiting for years to get just a chance to apply to immigrate here. When they come here, they are bringing their individuality, charm, wisdom and often – business acumen.

They become ‘Canadianized’ and we are the greater for it. The experience of Canada holds these newcomers, grabs, and transforms them and brings about this curious blend of work and play, outdoors and indoors, East meets West.

Huxley said it: “What we all do with our experiences will form our future and our destiny.”

Let’s face it and agree:

- To work here is a privilege.

- To live here is a true blessing.

- To study here is a benefit.

- To worship here is a natural.

- To love and hold here… is paradise.

All these thousands of people want to be here, struggle to be here. WE ARE HERE ALREADY! Let’s enjoy it. 2021 will be more spiritual, we will have more mindfulness. People will value their quality of life not just talk about it. Smelling those roses will mean stopping the car, getting out and sticking your nose in one. We all need to come closer to ourselves, discover that life is not money, not owning. Life is in the doing. The DOING, the actions we take!

Awareness of our lives today, not dwelling on yesterday and worrying about tomorrow, but doing the living today.

That and a compassion for others is — for us as REAL ESTATE entrepreneurs and as Canadians — the essence of Canada.

Doing the living today, living in the today actively. There only exists today, this hour, this moment for us to live in. We do not live in yesterday (unless we let it fester in our minds. We do not live in wishful tomorrow, we live now).

Spirituality, individuality, physical fitness, mental preparation, and faith all combined in the average Canadian will see us through any obstacle, any possible short-term gyrations. We will – as always – emerge on the other side … stronger, wiser, and happier than ever.

So, yes… this is the first day of the rest of your life, there will be a new year and you do live in paradise … Now YOU go make yourself happy! No one else can.

I wish you and yours an eventful, thoughtful, thankful, exciting, successful and above all HEALTHY year of 2021! Experience the unpredictable 2021 with a sense of wonder…

Oh…make this goal:

I will get into JOY every day!

QUESTIONS, QUESTIONS, COMMENTS

Q: You kept saying in your videos (Sept 29, Oct. 15, Nov. 15) that January 5 would be the key about who controls the economy. So, if Biden wins the Senate, bad for USA and us?

A: No, he just will be able to instill the democratic masterplan easier. The Fed is done, it can print more money, but with its continuous interest cuts it has shot all its bullets. The economy now has to be on its own or government has to ‘stimulate’ it, with a stimulus package. This package, now that Biden can control the Senate too can be bigger and faster to get to ‘the people’. So, a good thing for US and by implication Canada.

(AN ASIDE: It will be easier…but not easy! The Senate must have 60% of the vote on certain big-ticket items – see below)

Q: This low interest environment cannot possibly continue. It is against all economic theory. Markets determine rates by themselves and not government. Bonds determine mortgage rates.

A: Not sure what you mean, but world wide governments have already said that for 2 years rates (at least the rates that governments can determine) will stay low. Over 18 trillion of the world’s debt is negative! Hard to see bond markets soar higher. Our call? Mortgage rates will stay at all time lows (look at Denmark!).

EYEBROW RAISER

Interest rates keep astounding! Listen: You can get a 20-year mortgage in Denmark for 0%! Look it up here: https://financialpost.com/real-estate/mortgages/you-can-now-get-a-20-year-mortgage-in-denmark-for-0

Q: You don’t recommend Bitcoin, but its rising fast!

A: Let us be clear, I am a real state analyst, forecaster, and marketer. REAL ESTATE! Yes, I have ventured afield in reporting dissenting opinions, but I think that most of my audience is interested in real estate investment. Gold, stocks, bitcoin, etc. are just on everyone’s mind. I am ONLY interested in real estate investing.

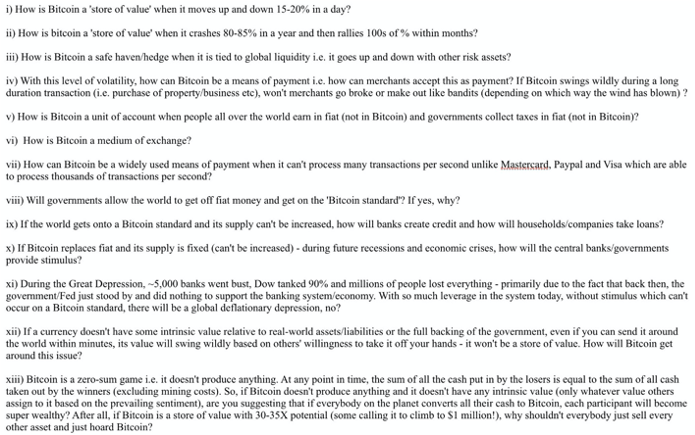

But one of you sent me this Bitcoin questionnaire and said: Have people ask these questions of bitcoin sellers:

Major Point: Enough please. No dear G.C., not even “just an Ozzie gut feel”. You play the game; you take the chances with YOUR money. I would add, that for the average guy/gal real estate has many – plus one really huge advantage. Real estate is all about leverage. Bitcoin, gold etc. investments do not have leverage. That $30,000 nest egg can get you a $300,000 property. If that property rises by 10% you make 100% on your money – or $300,000.

If you put that money in Bitcoin, gold etc. etc. and it rises 10% you make $3,000.

Last point: Gut feel? Down by 40% is possible. Nothing goes up forever this fast. It WILL take a break.

Q: Real Estate, stocks, gold, mortgages and of course Camembert. Where? At the one and only OzBuzz, of course.

A: Yep

Q: Your “tax of 4 cities”, was a real eye opener. It’s not taxes everywhere that’s the problem. It is Vancouver’s and Westcoast taxes and other costs that are problem. Think about gas! We pay $1.40, Alta .95 cents and Ontario $1.10…

A: Do not worry, we all will have soon the fine opportunity to have higher taxes foisted upon us (love the word “foisted”). It is equal opportunity tax time. First GST will go to 8%, then ‘pill marihuana’ will become cash cow medicine, then home equity free tax be attacked and, and, and… can you say wealth tax?

Q: Always a little suspicious of your stance on inflation. I have heard it from you before. But I absolutely was floored and loved your explanation of why governments talk 2% inflation, but the reason is simple. They are measuring a different basket without rent, without house prices, etc…, etc. Government does not lie per se…It is just that they changed the basket and what is in it, and that measure is 2%. If we measured ourselves as we did in the past, we would be talking 5- 8% already.

I never got it before. Now I do. The website www.shadowstats.com says it all.

A: Thank you, this argument I made for 30 years and it has served me and my subscribers well. Whenever and whatever you bought and whatever price you paid rose in value because ‘money creation’ settled in hard assets. Always! And now, we have the mother of all money creation!

Q: You profess to worry about solvency. Would not everyone that would need to go bankrupt, already have done so by now?

A: You are quite right. Many have and many are under bankruptcy protection. Solvency still remains an issue because untold thousands of businesses have been hanging on by their fingernails, robbing RRSPs and loans to survive. Usually collapses start slowly and then gather speed, as more people give up. We are not there yet (add to that Canada lost in December 63,000 jobs).The Bay cannot pay its $20 million a month in rent. They may close more stores. In the US, Macy’s is closing stores… Much more misery is looming. (But read last month’s bit on the top 75% of people doing just fine!)

HOWEVER, NOTE THIS (EYEBROW RAISER)

BCREA JUST RELEASED (Jan 8):

BC bucked the national #employment trend in December 2020 with a growth of 3,800 jobs, following a gain of 24,000 jobs in the previous month. The province continues to be at 99% of its pre-COVID-19 February employment level. #bcrea #bcreaEcon

Major Point: Maybe, dear Reader, I did not do your question as much justice as I should have. Maybe that is the real reason our housing markets are rocking!

Q: 18 questions/comments on inflation, reflation. I pick this one: You said we could have inflation (hard assets) and deflation (commodities) at the same time. What, if – as now – we have huge inflation in ALL commodities? What are the risks?

A: You are right: From Copper to Wheat, from bitcoin to lumber… soaring. The risk: Unmistakable consumer price inflation. A much more reflationary environment … the fiscal stimulus will mostly be monetized. Asset price inflation has been here since the summer.

What is new: Massive inflation is now visible to everybody!

Q.: You have liked Phoenix since 2015. You also talked Houston, Austin, and Dallas. It seems that you made good calls. Where to now?

A: First I talked and BOUGHT Phoenix in 2010 and onwards. Second, everyone is on the move into Texas and Arizona (Tennessee, Florida). Big boys like Tesla, Hewlett-Packard, Oracle. Its cheaper, lower taxes and – so far – reasonable governments. Where to now? No reason to change.

Q: Many forecasters talk “the big reset” or the supersecret “new climate plans addressing climate issues with monetary policy”

A: I have had several “YouTube babies” tell me about Harry Dent, Robert Kiyosaki, etc.etc. all making ‘end of the world’ forecasts. I will delve into their performance and credibility next issue.

Comments: Many questions on the vaccine (when do we get it, which is better – Pfizer or?), some disagree with “rents are plummeting (not in my area)”, some think our markets will crash (a la Dent). Isn’t it wonderful? Like at no time in history, are soo many people that can be heard (on Youtube) at the same time … and YOU – yes YOU, have the chance to make the call and be proven right … or not!

Q: Your call on the Canadian dollar was wrong. It went up. Ok, where do you see the US dollar and Canadian now? US dollar down or up?

A: Well, it went down first and then up. But yes, I argued that the US dollar will stay the reserve currency and thus get stronger. The Canadian dollar is tied to its natural resource and commodity sectors and their performance. If the US goes higher faster – not good for us.

Q: Ozzie, your call on Tesla was wrong. What say you now?

A: You are right, I did not and do not understand that stock valuation or that crazy market.. Look: Based on stock market evaluations … every Tesla sold represents $1.25 million dollars … EVERY TESLA! Every GM car represents $9,000. Total madness! Enjoy the ride. Or…sell…enjoy the profit. (From Michael Levy on Moneytalks.)

COMMENTS

Same as last month. Lots of comments and questions regarding my summary of the US election outcome. I mean lots. Lots of opinions. Thanks for sharing.

I repeat my Major Point: We will survive all governments, as a people, as a province and as Canada. The US election outcome possibly favours us. We will not know about the Senate until January 6. But our future is in our own hands … we need to be productive, innovative, and resourceful. We were more engaged in the US election than our own elections…why? We do business with 36 US states, we think we would care.

And for the worriers about Biden… note that important legislation – minimum wage-infrastructure spending and environmental legislation needs more than a majority of one (as it stands now). Needed are 60 votes – Democrats control 50 + VP. 9 Republicans need to be convinced. Likely? Yes, the Republicans are in a self-destruct mode.

No one talks pending tax increases much. However, when it will be launched all bets are off.

Again: If you are in the industry, in building, selling, marketing, developing lawyering, etc..,etc. list yourself in the FREE BC REAL ESTATE DIRECTORY: WWW.BCRED.CA

HOT PROPERTIES

Still selling too fast … by the time we publish – gone. Stay close to your realtor. Also, yes Ralph Case and I have a real estate investment company – a brokerage.

Jurock Case Investment Realty (JCIR.ca).

We specialize in investment properties and presales only!

Our real estate company JCIR will launch a NEW pre-sale building shortly. If you would like to get on any future list for either investments in Joint Ventures and/or presales … sign up at http://jcir.ca/

WORTH LISTENING TO:

Music: Ha-ha. A lot of comments on my “kooky twenties” music. People brought me Sarah Leander, Freddy Prince…wow. You are an old bunch of Europeans. I liked Raabe not because he is an old German playing the 20ties and 30ties, but I did and still like that particular song of his. I still listen to it. Just listening to it…makes me happy. “Today is a day to be happy! Yes, it is”.

BOOK RECOMMENDATION

Not a book but really worth a read.

Ray Dalio on the CHANGING WORLD ORDER.

He spells out what many fear, disorder is becoming the norm around the world

https://www.linkedin.com/pulse/archetypical-cycle-internal-order-disorder-ray-dalio/

If you have not bought your Douglas Murrays “The strange death of Europe” or his latest “The madness of crowds” do so now. Or at least google him and see some of the interviews.

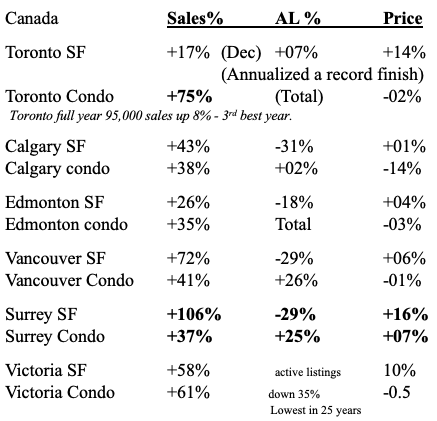

THE NUMBERS, THE NUMBERS IN CANADA

The BC Real Estate Association highlights enormous sales and price increases everywhere in BC.

BC bucked the national #employment trend in December 2020 with a growth of 3,800 jobs, following a gain of 24,000 jobs in the previous month.

The province continues to be at 99% of its pre-COVID-19 February employment level. #bcrea #bcreaEcon

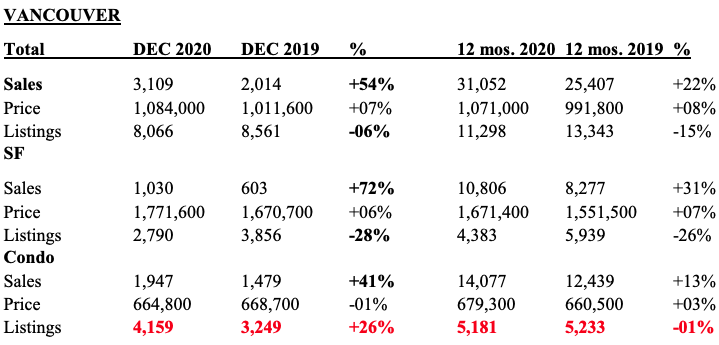

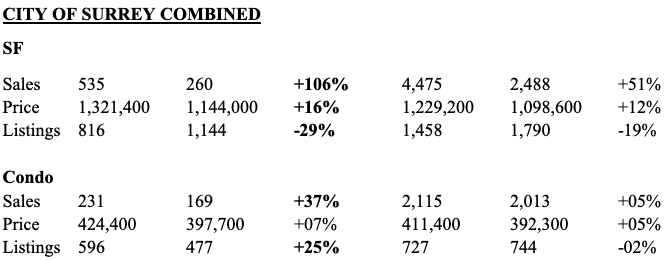

THE NUMBERS, THE NUMBERS VANCOUVER AND CITY OF SURREY COMBINED – December 2020, 2019 and RUNNING TOTAL YEAR OF 2019 AND 2020

Major Point: At year end we look at the annualized numbers as well as the month of December. (see my explanation in Q and A. Also, why we do not use the Benchmark price.) Vancouver sales of condos up a respectable 41% but only 13% on the year. Condo listings are now also rising but are still down a tad on a y-t-d basis. Still – like Surrey – inventory is up by 26% end of December. Condo prices turned negative on the month but still cling to a 3% gain y-t-d.

Major Point: Surrey rocks! SF sales shot 106% higher and annualized are up by 51%! SF prices are higher by 16% on the month and a very respectable 12% on a y-t-d basis. Also, Active Listings are down by 29% in December and down by 19% y-t-d. Clearly the SF and TH markets have been strong, are strong and will continue to be so.

Condo sales are up by 37% on the month but only by 5% y-t-d. Condo prices remain higher at 7% on the month and 5% y-t-d. Listings stay at a 25% increase (last 3 months) and on a y-t-d basis are about even.

Major Point 2: No change from last month for our outlook. As last month … the madness of the market in some area concerns me … too much – too fast. Solvency crisis around the corner. Retailers/restaurants crashing like crazy.

However, Democrats win in Georgia will mean that the stimulus fiscal package will be larger and spending it will start sooner… Good in the short term – also for Canada. (We export a lot to the US, not just lumber. US buying stuff – good for us.)

Remember: Use your realtor to drill into the numbers of the area or sub area YOU want to be in. The trend can be your friend, but you must understand what the trend is.

Also note:

Sales higher and staying higher (over last year), active listings lower and staying lower

- Trend= higher prices.

The opposite is the case when sales are lower, and listings go higher.

- Trend = lower prices

LIVE LIFE LARGE

The world is

a beautiful

Wondrous place

I thrive on my sense of wonder…

I love the beauty and joy of the

World, without lecturing, I am

committed to protect it.

I will grow into my future best…self.

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment