“Only a crisis – actual or perceived – produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes the politically inevitable.”

AGENDA

QUESTIONS, QUESTIONS – COMMENTS

MOST UNREPORTED INFLATION OF ALL TIME

CAMEMBERT

THE NUMBERS, THE NUMBERS – NOVEMBER | VANCOUVER – TORONTO

WHY BIG BOYS ARE BUYING ALBERTA AND BC

MISSION – SURREY A BUY

A (TAX) TALE OF 4 CITIES

BINGEWORTHY SHOWS – NEW BOOK RECOMMENDATIONS

PFIZER PRESIDENT SELLS 62 PERCENT, MODERNA EXECUTIVES SELL 98 MILLION!

COMMENTS AND QUESTIONS, QUESTIONS

Lots of comments and questions regarding my summary of the US election outcome. I mean lots.

Lots of opinions. Thanks for sharing.

I repeat my Major Point: We will survive all governments, as a people, as a province and as Canada. The US election outcome possibly favours us. We will not know about the Senate until January 6. But our future is in our own hands…we need to be productive, innovative, and resourceful. We were more engaged in the US election than our own elections…why? We do business with 36 US states, we think we would care.

QUICK FACTS ON THE REAL ESTATE FRONT

MINUS:

REAL ESTATE FACTS TO NOTE

In our March/April issues we forecast big pain ahead in big malls, all retail and disaster for hotels. During the last 2 months I also worried about a solvency crisis hitting us January to April. Last month I quoted the shut down of major clothing stores…Now…

Malls in trouble: Wall Street Journal reports: Malls file for bankruptcy or shut their doors as pandemic continues. Glut of retailers struggling with lower sales will continue to haunt the mall industry even after Covid-19 eases.

Major Point: We reported last fall that 1,100 malls in the US were shut in mid 2019 – well before COVID-19. When a big department store leaves, the 20 -30 stores that were feeding off them also go down.

The Bay in the Coquitlam Centre by mall owner Morguard Investments Limited states the company defaulted on rent payments and had to close.

According to a Toronto Star report, court records show the company has leases valued at $20 million a month and has not paid rent to eight landlords in Ontario, Quebec, British Columbia, and Florida.

Major Point: Every time a big box retailer shuts down, 20 – 50 small stores are affected that were feeding of the traffic.

RENTS ARE PLUMMETING:

Not everywhere but in big cities? Yes! San Francisco is down between 25 – 30% in town, NY the same – only worse. In many areas no tenants can be found at all!

Padmapper (October) – apartment-finder site, reports that Toronto and Vancouver, “still had double-digit year-over-year declines” in the month of September. However, there was a “monthly tapering”, which “may signal that the downswings are decelerating, and a rent price floor may be hit soon”.

They said that rent of a one-bedroom unit in Toronto dropped to $2,050 a month. This represents a one percent decline from the previous month and a 10.9 percent reduction year over year.

In Vancouver, the median rent of $2,000 in September for a one bedroom stayed flat from August. However, the figure constitutes a 7.8 percent decline compared to September 2019.

Major Point: Love your current tenants. Fix everything, make it hard for them to think about leaving. (Think about being empty for a month or two, versus fixing something. A very long-time ago, I bought small TVs for my tenants).

PLUS:

WHY BIG BOYS – LIKE MAINSTREET – ARE BUYING ALBERTA AND BC

So far this year, Mainstreet has spent approximately $89 million buying apartment buildings, mostly in Alberta. In July, the company paid over $30 million for a 188-unit Calgary building. So far, the largest multi-family deal this year.

“There are only 2.2 million purpose-built rental apartments in Canada and the federal government wants to raise immigration to 1.2 million people over the next three years,” says Mainstreet CEO Dhillon.

He plans to buy in small B.C. cities and towns, likely, north of Victoria on Vancouver Island and Interior locations such as Penticton and Kamloops.

He will also skirt inner Metro Vancouver, which he believes is overpriced, but plans to be buying in Abbotsford and Chilliwack.

Major Point: Mainstreet is here already. They own a reported 2,800 units in Abbotsford and Surrey, respectively, 24 per cent and 34 per cent of the rental apartment market (Canaccord Genuity Capital Markets).

EYEBROW RAISING MISTAKE?

Evan Siddall, (past) chief executive officer at Canada Mortgage & Housing Corp., said May 11 in remarks prepared for an appearance before the House of Commons Standing Committee on Finance in Ottawa that CMHC sees home prices falling as much as 18%!

In fact: They are UP 14% in Canada, 21% SF in Surrey, 21% in TH in Ottawa

MISSION

Planning 40,000 people on over 4,000 acres. Polygon’s waterfront 3,400-acre Silverdale subdivision starts now. Mission also preps for final push on a long-planned transformation of 286 acres of prime waterfront.

Major Point: Buy some real estate nearby.

SURREY

For some 7 years – until 2017, I had the privilege of being one of the judges for the Fraser Valley Real Estate Commercial Division building awards. Some 40 – 50 projects were nominated, and I saw most of them. I was very impressed by the quality of the developments, the greening efforts and the ever changing more useful construction ideas. Of course, it was easy to give big awards to the new Surrey Library (you gotta go see it), the new City centre etc. It was not so easy to recommend you buy in Whalley. Such a poor reputation.

Well, we recommended it! On price and proximity to Sky Train plus 1000 people a month moving there, and we particularly liked developments by ace community builder Charan Sethi of Tien Sher (https://tiensher.com/about-us/), who spearheaded the perception of Whalley into ‘Historic Whalley’. Watch for his astounding new vision in his upcoming newest buildings.

He is clear in his love and belief in the area “Where excellence in innovation and execution meets practicality and results in a superior price for the consumer.”

Now 1,500 people a month are moving to Surrey and the idea of TOD (Transit oriented developments) which we preached for years, has become a buzzword.

People forget the bad raps of YaleTown, Mount Pleasant, MiddleGate and others, before they became trendy and prices soared.

And while out of favour they were real good buys. Whalley could be the same.

Major Point: Buy Surrey, Langley – but buy close to good transit…

RECOMMENDATIONS

- A great resource is www.roomvu.com. The best place to get statistics tailor made – go to roomvu.com. Want to have listings that are below assessed value…they provide it like this:

Please find the mid-month roundup of 19 Bargain (20% plus below assessed value) Homes in Vancouver below: https://docs.google.com/document/d/1UE9uFVKTNjBA5EqI6cbkBx18pRayvhXIbVdYNYcVwPE/edit?usp=sharing

If you are a realtor or in the industry or simply want to know more…Check it out! 2 - If you are in the industry, in building, selling, marketing, developing lawyering, etc.,etc. list yourself in the FREE BC REAL ESTATE DIRECTORY: WWW.BCRED.Ca

HOT PROPERTIES

Still selling too fast…by the time we publish – gone. Stay close to your realtor. Also, yes Ralph Case and I have a real estate investment company – a brokerage. Jurock Case Investment realty (JCIR.ca). We specialize in investment properties and presales only. We currently do not offer any pre-sales. If you like to get on any future list for either investments in Joint Ventures and/or presales…leave your email address at jcir.ca

VACCINE

Lots of responses to my note on Pfizer. Like: Why is the vaccine important to real estate and why is it important to talk about the CEO selling his stock?

A: 1. This is a brilliant technological achievement. A game changer. We seem to act collectively as humans much better in a crisis. And our researchers acted worldwide. Wonderful. It is of course of utmost importance to confidence, all markets, the economy and real estate.

A: 2. Why is it important to mention that this CEO of Pfizer announces successful vaccine on a Monday and then sells 62% of his stock on a Tuesday?

A: 3. Moderna also announced a vaccine Thursday and its executives sell 98 million stock Friday!

Major Point: I am positive about the news, but cynical on the timing of the sales by executives. They certainly do not expect their stocks to rise further. So, what do they know, what do they expect to happen?

In the meantime, it is fantastic news … Now, when is it a) available and b) to you?

CRAZINESS

Q: You mention Turkey and other countries currency collapsing, their yields suspect and yet you consider Spain and Portugal a good place to retire to?

A: Well, two different things: Lifestyle and assets. Here you get a (relatively) easy visa and can keep your money in dollars or Swiss francs.

Actually, if you have to buy real estate in order to get the visa, that will help you – as real estate in these two countries and elsewhere will possibly rise in relation to their collapsing currencies.

Q: Why do you always talk about Europe and the world. Why is it important to us?

A: Immigration. The crazier Europe and Asia gets, the more likely is it that Trudeau’s target of 450,000 immigrants a year will be coming true. And they will all need a rental or purchasable unit to live…Good for real estate. Also, Trudeau’s goal is to relocate some of them to smaller centres like Vernon. Nothing firm yet, but wherever people go, values grow!

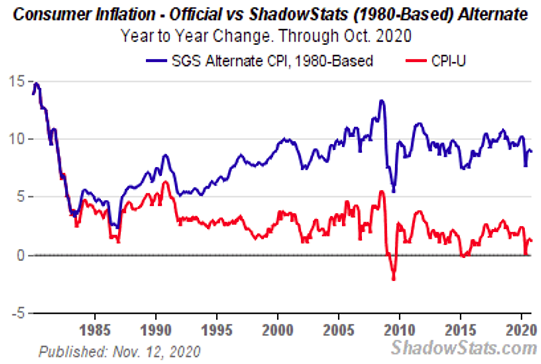

Q: You continuously talk about “most unreported inflation of all times”. Yet, governments around the world have that 2% target, not just Canada. I do not get it.

A: Best to read my OzBuzz 39 and listen to my speech for BCIT and the GCBA on my youtube.com/jurockvideo channel. Here it is in a nutshell simplified:

There are a dozen different ways to calculate inflation. All are evaluated on a ‘basket of things’ that get measured, based on the bias of the evaluators (usually governments).

So, the “Volker basket” in 1981 included house prices, gas, oil, rents, food, and government services. Inflation was 12%. (15% in 1085). Similar to the Canadian government at the time. However, since in the US entitlements, pensions etc. are all tied to the official inflation rate, it became quickly apparent that governments had to do something – in the US government’s interest to keep the rate much lower. (Imagine having to pay a 12% increase in pensions.)

Similar in Canada. I think of inflation as to what it costs me to live versus a year ago at this time. Cost price inflation. Economists call me naïve.

Maybe…

But governments came up with the concept (my opinion):

What rises the most, we take out of the basket!

So, 1) Take rents. Up 2%? Rents tripled in 10 years, gas quadruped in 18 years, Food? House prices? Too many things to mention.

2) At the same time, all government service fee increases are not in the basket. Neither Federally, Provincially nor Municipal.

3) Taxes…2% right? Hahahah!

Take parking.

20 years ago, you paid for parking on the street 10–4 = 5 days a week, then it became 10-5, 10-7, 9-7 and now it is 9 to 10 = 7 days a week. There were no parking fees at all in ANY park, now it costs about $15 – $25 a day.

There are many insidious increases, that are not reported. Passports are 4 times the cost of 10 years ago, swimming pools. Etc.etc.

So, the average guy brings in maybe $40,000 and his wife says groceries have gone crazy – and forget about your camembert it went from $8 to $11 in a year. He goes to his boss, he says, I need a raise. Boss says: Ok, here you are 2% – or $800 a year.

He cannot make ends meet. While we profess to help the “little guy” which is now the “lower middle class”, we punish him constantly.

Wanna take that family to the park? He does not have that $20, go to the beach? Ditto.

So, I say it is simple: look at anything you and I need to live, it is up more than 2%. Everything much higher. You can call it what you like it is price inflation. To me that is the measure we should use, not some economic model to suit a particular circumstance.

On real estate costs? Strata fees, taxes, management skyrocket, while rent increases are frozen or limited (even pre virus) (insurance is up 60%). That is also why listings of rental properties are soaring – with many price reductions.

Not to belabour the point (which I already did): Think hard and tell me what – in order for you live – has gone up only 2%. And do not tell me electronics…

The world ‘elite’ is rushing, running, fighting into hard assets – WORLDWIDE! Money is ever cheaper and available. The outcome the ‘K’ economy – rich get richer – poor get poorer and the gap widens. With costs to live constantly rising and income not keeping pace and no real estate or other assts to speak of the lower part of the ‘K’ is doomed to get more into debt, while the upper part, spends less saves more and see its assets soaring. Ok, of course real estate is my choice of hard asset.

INFLATION STATS COMPARING THE BASKET PRE 1990 TO TODAY…TELLS ALL

http://www.shadowstats.com/alternate_data/inflation-charts

As of November 12, Governments says we are at 2% or so…using a basket used pre 1990 we are closer to 8%!

CAMENBERT

THE QUESTION OF HYPER INFLATION

I must admit, I do love to engage with some of you…It is absolutely wonderful to have intelligent people debate respecting each other’s point of view – if not agreeing.

Hyper inflation means an increase of multi thousand percent in value.

Ok, surely Ozzie, we will never have hyper inflation.

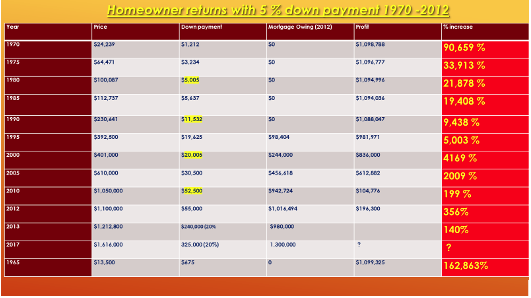

Well, you live in one now. In Vancouver in 1965 our average SF home was $16,500. In 2012 it was $1,100,000 or so. You bet your boots that increase is hyper! Ah, you say, I see. No, you do not. Since then, we added another $600 000 or so to the average home price of today. 50% in 8 years.

It is HYPER inflation to go from $13,500 to 1.7 million. Its not that we get hyper inflation, we have been in one. It is just a matter of the time frame…Look at the percentages increases on your down payment…22,000 to 90,000 percent.

It is like the frog in boiling water…He doesn’t notice he is in it. Here is a chart – for fun:

Major Point: Will it continue…It has for 55 years! If we keep printing money (and we are) with ups and downs – yes!

A (TAX) TALE OF 4 CITIES

Vancouver’s empty homes tax will double next year to three per cent, triple over 2 years ago.

Council voted to double the empty homes tax to three per cent next year after a new report from CMHC showed a significant increase in the supply of rental condominiums in 2019.

The empty homes tax, which was to be set at 1.5 per cent for the 2021 tax year, was implemented by the previous council. Council: ‘If people are rich enough to own an empty house, they’re rich enough to help provide for people who don’t have housing’

Ok, what about the Property Tax:

Vancouver

- 7% increase for 2020,

- 6.3% increase for 2019,

- 4.9% increase in 2018

- a total increase of 23.2% for the last four years plus the 5% proposed for 2021.

By comparison:

Victoria

Financial relief for Victoria residents includes no 2020 property tax increase

2019 City of Victoria +3.98%

2020 City of Victoria 0.00%

Calgary

Council reduced the previously approved 3.03 per cent tax rate increase for 2020 to 1.5 per cent and approved a rebate from one-time funding from the 2019 Corporate Program savings to cover the 1.5 per cent rate increase.

Edmonton

Councillors voted 9-4 in favour of raising residential property taxes to 2.5 per cent and freezing property taxes for non-residential ratepayers. The justification for raising taxes on homeowners was to help out struggling businesses.

Overall though, when combined with the decrease in the provincial education portion, both homeowners and businesses will see a decrease: zero per cent for residential ratepayers (a $28 decrease for the average home worth $387,000) and a two per cent decrease for non-residential ratepayers.

So, Edmonton and Victoria no increase, Calgary a rebate…and Vancouver…?

BITCOIN AND GOLD

Too many questions. The rise of Bitcoin and gold, or the increase/collapse of them is in many reader’s mind.

I have no answers for you. The interest though that you and the media (now) show, by itself will have an impact on its performance

===============================================================

OZBUZZ TO WATCH:

Ozzie Interviews Michael Campbell, Michael Geller, John Westin, Janet Lepage, David Steele and so many more at Ozbuzz.ca

===============================================================

WORTH LISTENING TO:

Music: Ok, ok, I admit, I am early…But our tree is up, the fireplaces are decorated with Mistle Toe (one hanging for the kissing) – it’s Christmas Holiday music all day long…

And being completely hokey, I have gone back to my (German) roots and I am listening to happy, simple music by Max Raabe. Anyone under 50 go look at my Rammstein and Oomph recommendations on blip.fm, but those of us of refined age, and superb hearing tastes and fond memories proceed…ha-ha. Here is my happy song of the week. So, good to hum to: “Guten Tag, liebes Glück” (Good day, today is a good day to be happy, lucky).

BOOKS OF THE WEEK COMMENTS

1. Storyworthy – Mathew Dicks

1. Storyworthy – Mathew Dicks

Engage, Teach, Persuade, And Change Your Life Through the Power of Storytelling how to tell a great story – and why doing so matters. Whether we realize it or not, we are always telling stories

2. Tiny Habits – small changes that change everything by BJ FOGG

BINGE WATCHING

THE QUEENS GAMBIT:

A long, long time ago I was the president of the White Rock Chess Club. We were a small, underfunded club playing in the local high school. It was hard to get members. Then Bobby Fisher came on the scene, made chess popular again and we were able to afford our first 10 chess clocks. Once kids found out you can play Chess in 5 minutes, we were run over with students wanting to join.

This movie will have the same effect. It will revive chess.

I loved the movie because all games were real (even the ones Beth sees in the ceiling.) Grandmasters like Kasparov were advisors. Of course, Beth’s first boyfriend was the brother of Harry Potter, Benny clearly is meant to be Bobby Fisher… and, and and… Oh, go watch the series yourself…

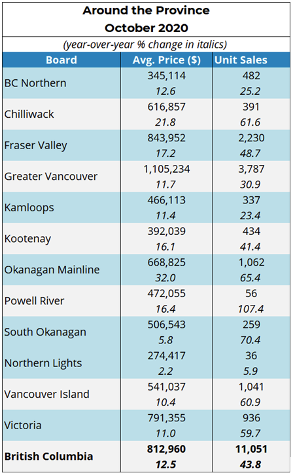

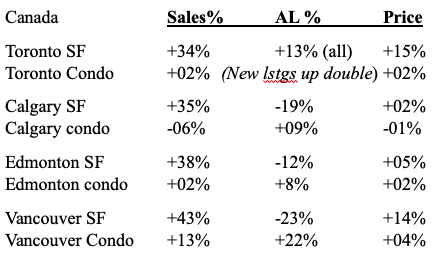

THE NUMBERS, THE NUMBERS IN CANADA

The BC Real Estate Association highlights enormous sales and price increases everywhere in BC. Look at Powell River sales up 107%, Chilliwack 61% etc.

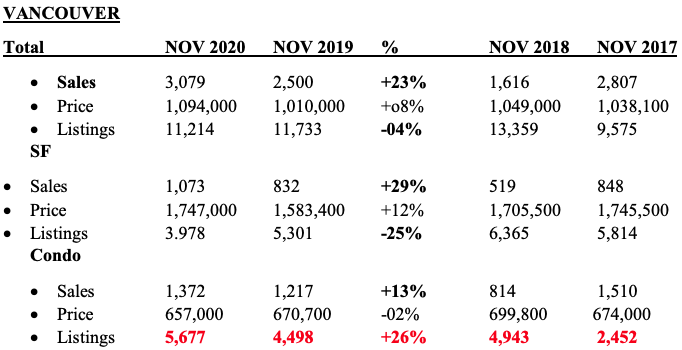

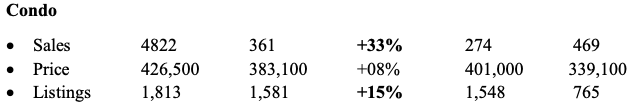

THE NUMBERS, THE NUMBERS VANCOUVER AND CITY OF SURREY COMBINED – November 2020, 2019, 2018, 2017

November gets stronger in most areas but not all.

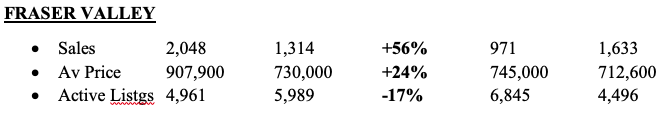

Major Point: A good November in Vancouver. Just look at 2018. We have double the performance in all sectors. But sales percentage increases are slowing and condo sales while up, are lagging behind 2017 November. Condo listings are rising and at 100 plus percent higher than 2017. Finally, condo sales overall show their first decline (as we hinted as the possibility in previous OzBuzz), likely more down in downtown and higher in suburbs. Look at Fraser Valley for instance below.

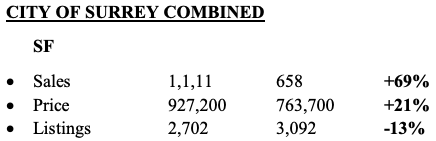

Major Point: Sales overall are up a whopping 56% (SF sales in city of Surrey up 69%!) Active listings still down 17% but the price? Wow…up 24%!

Major Point: Surrey rocks! SF prices are higher by 21%! SF sales are up 69%! Condo prices higher by 8%. Sales up 33%. Both handily outperforming Vancouver. Listings still down but by only 13%. Surrey condo listings are not rising as fast as elsewhere, condo prices are up again a strong 8% (Vancouver condos are now down by 2%).

Major Point 2: No change from last month for our outlook. As last month… the madness of the market in some area concerns me…too much – too fast. Solvency crisis around the corner. Retailers/restaurants crashing like crazy.

Needless to say, when you look at averages in the Fraser Valley you look from Surrey to Langley and White Rock to Cloverdale. THIS IS VERY IMPORTANT. Some sub areas are building active listings, and some are not. Always drill into the numbers of the area YOU want to be in.

LIVE LIFE LARGE

Feeling good

Is more important than

Anything else.

To feel better is the root

Of every desire.

Look up (and buy) all the “Grow into your future best” cards at: www.commitperformmeasure.com

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment