“Sleep is for people without access to the MLS.”

AGENDA

- HOT PROPERTIES

- THE NUMBERS, THE NUMBERS – VANCOUVER AND FRASER VALLEY ROCK

- QUESTIONS, QUESTIONS – I MEAN QUESTIONS!

- REAL ESTATE ACE FORECASTS 100% INCREASE IN VANCOUVER PRICES

- HOME EQUITY TAX NOW A BC OBJECTIVE?

- LOYAL OPPOSITION

- FALL FORECASTS

- COMMENTS

- BINGEWORTHY SHOWS

QUESTIONS, QUESTIONS

Q: I don’t agree with your stance of supporting government, on the Michael Campbell show and on your YouTube channel (jurockvideo). Who can support the liberals?

A: We can disagree with what our government does, but we still must be loyal to it. That’s a democracy! We are meant to be debating and discussing…everything… The government being elected, doing stuff and the opposition watching their every move.

I have written about it a number of times. My biggest concern is the worldwide polarization of positions. Left versus right, without mercy: “You must agree with my position. And if you don’t you are a loser”. What we are seeing all over the world: Germany, Italy, Hungary, the US is a “my way or the highway world.” CNN watchers and Fox watchers. Not debating but hating!

The election in the US will not be supported by whoever loses. Blood on the street. And the world worse off for it.

I quoted Churchill: “Democracy is the worst form of government…but it is the best we have”. And I get the admonishing finger? Just because I don’t like the current government and you like it; does not mean I hate you. It means that we can intelligently debate. I support our democracy, I believe in loyal opposition … the Key word: LOYAL to my government, my system of government. Partly why the world’s masses want to be here, partly because we already have it. So, let’s you and I debate, argue, then vote – but stay loyal to Canada, loyal to the institution argue like heck to defend your belief. But in the end – support!

Q. Curious, you seem to have left out unemployment numbers, people only getting by because of CERB, mortgage deferrals and so on. Don’t you believe that both rents and prices will see a decent sized 15%+ fall this winter?

A: I do not, but I concede, I may be wrong. I think the defaults will keep rents low.

Q: We had an accepted offer on a great house in Kelowna in an area we like. We think we got a deal, but with the future uncertainty who knows. But I heard you and Kiyosaki say, buy the ugly house on the nice block and buy a great deal, so we think we did both.

A: Please do not lump me together with Mr. Kiyosaki. He has gone to the dark side. The ‘end of the world’ and ‘its all a conspiracy’ side! Not me!

Q: …Of course, we don’t know if and when CMHC’s study will be implemented or what it will look like, but it would be nice if the government stopped taking from the responsible and giving into the ‘demands’ of the irresponsible. Stay healthy kind sir! Thanks for listening.

A: So many letters of support in wanting to fight the Home Equity Tax. Several feel that we won the battle and that the FEDS have backed because of our stance. Ha-ha. That’s the Feds, what about BC? You can bet your last nickel; they are studying it!

Q: Hi Ozzie, Love hearing from you; love your sense of humor: location, location, location! Good one! I’ve been following you and Mike on your ‘theories’ about the government wanting to start taxing our primary residence and then of course, you bring to our attention CMHC’s latest study.

In today’s Bloomberg news release, there was an article called Some older personal finance rules may no longer apply. In it, it says “Renting can still be a good financial decision, so long as people save for retirement as they won’t accrue equity in their housing.” … the author of the below article missed CMHC’s latest study entirely. https://www.bnnbloomberg.ca/some-older-personal-finance-rules-may-no-longer-apply-experts-say-1.1469831

A: Thanks for sharing.

Q: I like your summary of government help sites, thanks.

A: You are welcome!

Q: You are not a medical doctor. Stay away from making virus predictions. Stick with Real Estate.

A 1: I am not a developer either, still make predictions about timing for presales. This is written for investors. In fact, on my predictions I have received many opposite comments. “Your March comments on the virus peaking in April and the tapering off into the summer were bang on.” As well your “it would be over sooner rather than later.”

Actually, all we did, we based it on the Wuhan experience and a sense that we usually overreact to all “Black Swan “events…

However, the most questions I received were follow ups our March comments: “What now?” “So far so good, but you also made a comment about this fall (2nd wave) being the unpredictable part and “solvency crisis”. What exactly do you see?

A 2: Indeed, nobody knows the exact outcome…what we know, is that we don’t know. To be extremely cautious remains a good stance.

Q: You directed me to Ray Dalio. I found him fascinating – get out of cash, get into gold, balance etc. Then after the 10th or so video I sat back and asked myself: What did he say? When is it going to happen, what to buy? Huh?

A: You’ll find the same with most thinking gurus. They don’t know when either. But when they say now or in the next 10 years … I switch off. If I had listened to all the gurus in 2008 who said don’t buy real estate, I would have missed the biggest boom ever. So, stay in cash, till you run across the deal of a lifetime – now or this fall.

Q: Thanks for your VPN recommendation! Which one do you use?

A: I am not getting any commissions. They are easy to research. Pick one where you can be served from a server located NOT in Vancouver … there are some fine reasons for that. If you get a server from a European or Asian city … you can actually check out flights, purchases etc. in those locations.

Comments:

- “The person who wrote that you are all over the place” is wrong. I love your book recommendations, your binge watching, and I miss “words I hate.” Real Estate is a bonus.

- “The government strata insurance changes are welcome but fall far short of what is needed. It is my view that the strata market will collapse – if we do not bring in an ICBC type insurance. My strata fees doubled. Others tripled. Who can afford that”?

- Residential tenancy repayment plans update. The debt is incurred, it will never be repaid. Landlords and tenant will be stuck in a “pay me or don’t pay me, leave my place – merry go round”

- Can’t believe how many big companies have gone out of business… Your Wikipedia summary opened my eyes…I’m getting into cash.

- I don’t care about house prices in Manila.

- The US is ready to collapse into civil war. Write about that.

- You have not done any podcasts lately.

- You will only be successful in YouTube if you do a new video every day! Believe me!

- 731 opioid deaths since January. Total BC Virus deaths? 189! Not the same thing

- My wife and I will check out Barbados “free year”. Heck of an idea!

- Where is the free book offered?

- Why does Giustra’s opinion matter? He just sent me a vegan recipe!!? Together with the end of the world?

MARKETING ACE CAMERON MCNEILL SAYS: PRICES WILL DOUBLE

In a recent article published, the executive director and partner of MLA says: “I am constantly asked to make predictions of the real estate market. I study the stats and the data, and lately I’m as equally perplexed as the economists clearly are. I’d like to give a definitive prediction of Q3 and Q4, 2020, but this year I cannot. Yet one thing remains abundantly clear, one immutable truth that remains constant; Canada, and in particular Metro Vancouver, remains one of the most desirable places in the world to live.

The demise of the modern city has been predicted for many years. And yet urban centres around the globe continue to grow at seemingly unfathomable speed. In just fifteen years from now, Canada’s population is estimated to be 42,250,000 – roughly the same as the projected population of greater Delhi. In fact, pick any two of the ten largest mega-cities worldwide (Delhi, Tokyo, Shanghai, Dhaka, Cairo, Bombay, Kinshasa, Mexico City, Beijing, Sao Paulo) and their combined projected 2035 population will exceed all of Canada.

Sitting at the mid-point of 2020 we are faced with socioeconomic uncertainty ahead. Real estate prices have not weakened as both Canada and Vancouver have seen transactions and supply fall. Our economic recovery will be bumpy, and the housing market may follow. Yet, a recession coupled with a rising inventory of sales listings as some people are forced to sell, may create a ‘best in 10 years’ buying opportunity. Low interest rates, low supply, and a strong conviction about Vancouver’s future may bridge this recession gap. Don’t hold your breath waiting for prices to collapse and don’t be surprised if Vancouver housing prices remain sticky despite our bumpy economy. As the past 40 years have shown us, waiting on the real estate sidelines is a losing game. It could be six, 12, or 18 months out, but conditions are lining up for another real estate price surge in the medium-term.

Although I cannot easily make a prediction for the balance of 2020, I can make a confident long-term prediction: In 2035 the average price of a home in Vancouver will more than double from 2020 values. (That’s roughly 4.75% compounded annual return). A $1,000,000 home will exceed $2,000,000 in 15 years.”

Major Point: Like most sane forecasters … he does not know ‘wither’ this fall or winter … but remains convinced like us, that long term we are the place to be for lifestyle, climate and yes – best price increases.

Q: You have written many times about retiring overseas, buying real estate and get a passport at the same time. I looked at the best countries in terms of investment needed to get a passport. What about lifestyles?

A: Can’t answer, because countries are different as day and night, and your income, your expected lifestyle and age all play a role. Best to subscribe to Kathleen Peddicord editorial@liveandinvestoverseas.com. Where the latest issue she talks about living in Paris! It may be cheaper living there than elsewhere … but … alas no passport.

Q: You are concerned about the fall? 2nd wave of virus or economy?

A: Well, we have enormous governments deficit (unprecedented), enormous private debt, a cataclysmic decline in economic activity. (Mortgage deferrals finish, subsidies finish etc.)

Why are we here? Governments felt they HAD TO contain by closing down. NOW we are in the reopening phase. IF there is no 2nd wave of virus in the fall, then we need to recuperate to the still unclear New NORMAL.

BINGEWORTHY SHOWS – OLDIES:

- Every US election we review ‘West Wing’ … a great binge leading up to US election

- Action? Another old one is ‘Justified’

- ‘Rita’ Scandinavian teacher and her unique style of teaching

BOOK OF THE WEEK

Too many irons in the fire … running SOOO hard but standing still. I recommended Gary Keller’s book “The One Thing” before … this is a neat summary follow up. Summary of The ONE Thing by Gary Keller: Conversation Starters Paperback. EVERY GOOD BOOK CONTAINS A WORLD FAR DEEPER than the surface of its pages. The characters and their world come alive, and the characters and its world still live on. Conversation Starters is peppered with questions designed to bring us beneath the surface of the page and invite us into the world that lives on.

Too many irons in the fire … running SOOO hard but standing still. I recommended Gary Keller’s book “The One Thing” before … this is a neat summary follow up. Summary of The ONE Thing by Gary Keller: Conversation Starters Paperback. EVERY GOOD BOOK CONTAINS A WORLD FAR DEEPER than the surface of its pages. The characters and their world come alive, and the characters and its world still live on. Conversation Starters is peppered with questions designed to bring us beneath the surface of the page and invite us into the world that lives on.

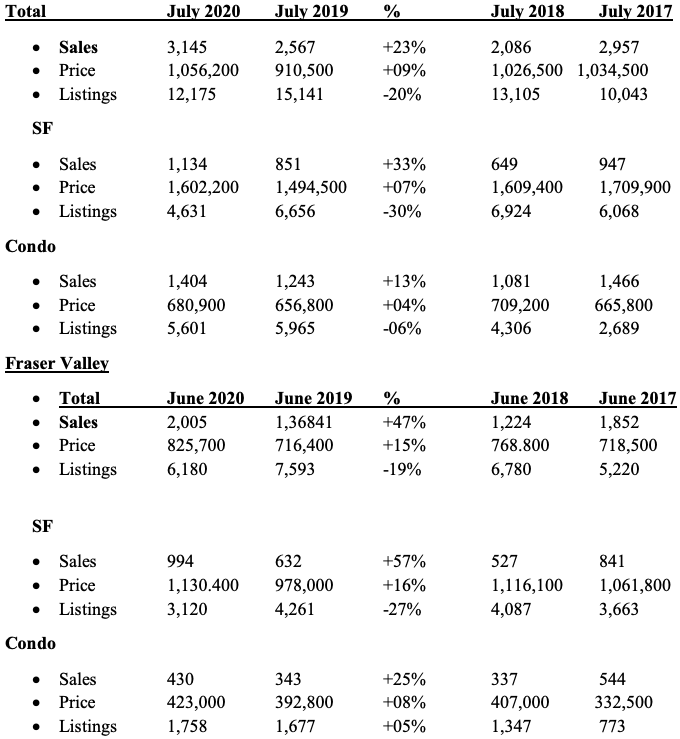

THE NUMBERS THE NUMBERS VANCOUVER AND FRASER VALLEY

June’s dramatic turnaround continued in July. Sales in Vancouver are up July over July overall 23%. The price was not only higher by 9% (!) across the board, but better than 2019 2,018 and 2,017 (!). Active listings are lower than 2019 and 2018.

Vancouver, on the SF home side … sales are higher by a whopping 33% and prices are higher by 7% and listings lower than 2019, 2018 and 2017.

Condo prices clocked in better than 2019,2018,2017! And condo sales? Higher than 2019 and 2018.

For the Valley even more spectacular: Overall prices soared 15% . ..and are the highest average price in 4 years. SF prices even better: up 16%, condos up 8%.

SF sales rocked higher at 57% best in 4 years and SF listings lowest also in 4 years.

Condo sales climbed 25%, prices rose by 8% but (something new to watch?!) inventory rose by 5%

Major Point: Needless to say, when you look at averages in the Fraser Valley you look from Surrey to Langley White Rock to Cloverdale. Always drill into the numbers of the area YOU want to be in.

HOT PROPERTIES

With the market heating up, we have added a few “hot properties”. If interested send me your email and I will get the owner or agent get in touch. We make no recommendations; you have to check it out yourself.

- Richmond – 4 yr. old, 990 sq. ft., top floor 2-bdrm plus den. Approx. $30k below assessment. Price reduced to $679,000. Super Richmond location. Walk to everything, trails, shopping, fitness etc. and Owner is motivated.

- Chilliwack with rentals allowed: Spadina avenue,1 bath, 1 br price: $149900

- Chilliwack, top floor, Mcintosh drive: $159,900

- Clearbrook, top floor, 2BR 1 bath $194,500

- Quesnel, 2 BR, 1 bath, $86,900 close to hospital

LIVE LIFE LARGE

Truthful people have

Better relationships

Conscience

Is awareness of truth

Weed out liars

Weed out phonies

Look for long term relationships

LIVE LIFE LARGE

Look up all the

“Grow into your future best” cards at: www.commitperformmeasure.com

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment