“If I had asked people what they wanted, they would have said faster horses.”

AGENDA

- QUESTIONS, QUESTIONS AND THEN MORE QUESTIONS!

- CMHC – USE OF FUND RESTRICTION!!

- COMMERCIAL HELP PROGRAM

- IMMIGRATION

- GOLD AND SILVER – STOCKS – JEWELRY

- MAY NUMBERS – SALES DOWN, LISINGS DOWN. PRICES UP!

- WHEN WILL PRICES GO UP?

- LANDLORDS WATCH IT, YOU MAY BE FORBIDDEN TO EVICT RETAIL CLIENTS

- “HOT PROPERTIES” – WILL BE SENT OUT SEPARATELY

Go to Ozzie’s youtube channel and listen to Ozzie’s latest podcast interviewing? Ozzie!

There are a dozen new initiatives and changes brought about by governments and institutions. Too many to feature here. Our publication is aimed at real estate investors and participants. I think the next three are most relevant: 1. CMHC forbids some uses of funds it lends; 2. There is a commercial rent assist program; 3. If you as a landlord do not apply … you cannot evict commercial tenants.

NEW CMHC USE OF FUNDS RESTRICTION

Significant and permanent is this decision from CMHC. So says Colliers: “Our opinion is that this change will produce an outcome that goes against CMHC’s goal of supporting growth in the housing market.” CMHC is implementing a restriction on use of funds in relation to their multi-unit mortgage loan insurance (5+ units) market refinance product. As of May 28th, 2020, the use of refinance proceeds is now limited to one or more of the following purposes as it relates to residential housing:

- Purchases

- Construction

- Capital repairs/improvements, including for increased energy efficiency and accessibility.

- Securing permanent financing (take-out financing to pay off a short-term construction loan)

- Certain other uses may be permitted on a case- by-case basis; however, in no event shall equity take-out or distributions to shareholders be permitted.

Major Point: The saying is: I do not know…and maybe even I don’t know what I don’t know. The last two weeks has seen CMHC announce a flurry (nay – a barrage) of bad news: Calling mortgage deferral an arrears, predicting an 18% collapse in prices etc. etc. This new one…is astounding. So, what do they know (or worry about) what I and you don’t know??? They worry me!

Read more here: https://mailchi.mp/3a4c958e5080/apartment-update-11-city-proposes-234bn-housing-plan-12499917?e=67cd64e1e5

(also links to a fine Colliers seminar).

GOVERNMENT COMMERCIAL HELP PROGRAM

The fine international Law firm of Faskens put together this outline on the commercial rent assistance program

https://www.fasken.com/en/knowledge/2020/04/24-covid-19-canada-emergency-rent-assistance

BC GOVERNMENT STOPS EVICTIONS ON COMMERCIAL RETAIL PROPERTIES

That is to mean: If YOU as a landlord do not apply for the assistance, you cannot evict… https://vancouversun.com/news/local-news/covid-19-finance-officials-to-share-next-steps-in-b-c-s-action-plan

QUESTIONS, QUESTIONS

A veritable barrage of questions. I have answered ALL of them, because I could (stuck at home), but my answers generated more new even larger response … so back to the past: I will pick some questions and answer them only here.

Q: As a forecaster myself, I am surprised at the number of calls you make that actually come true. China going after Hong Kong and Taiwan is actually now happening.

A: Well, I ran a construction management company in Taiwan. Taiwan sees itself as the rightful “all China” government for all of China (that is why there is one island, but 3 levels of government). The repatriation of the ‘renegade provinces’ remains a long term – never to be forgotten – goal of Mainland China. When (the old) Trudeau kicked Taiwan out of the UN, he set in motion the possibility of re-unification. The new Trudeau is placating China just like the old Trudeau. The real surprise? China is going after India NOW. Long-term after Africa. The west has been placated and has been kowtowing to China for 20 years. Since Trump does not, XI is taking the gloves off – for all to see. The West is now seen as fragmented and weak.

Q: Your prediction that the high of the virus would be in April and then taper off into the summer. (On your video from April 6 you even said by July) came true. Please tell me when the 2nd wave starts and finishes.

A: Ok, ok, tongue in cheek: I get it. But of you re-read Ozbuzz 43 I made a lot of more important evaluations and predictions – I stick to them.

Q: Your predictions rock! You predicted a 4-day week (other, other) … now Trudeau is considering it!

A: If he considers it … maybe not such a good idea…

Q: I like your videos. Why not go all video?

A: I presume you mean my youtube.com/jurockvideo channel? Yes, we will shortly start a series of videos on all things real estate. Remember, if you go to my YouTube channel CLICK ON SUBSCRIPTIONS (it’s much like a “like” on Facebook) and, if you like what you see/hear leave a positive comment.

Q: Your view on immigration both international and provincial?

A: In the May 11 youtube.com/jurockvideo … I quoted Daryl Simpson of Bosa saying that interprovincial inward migration could be up by 10%. In MY May 20 video I quoted that the Federal Government is continuing its immigration program approving immigrants. The target is 350,000 a year! When the flying starts again, immigration into Canada will surge! If we were a popular destination before, you ‘aint seen nottin yet!’ Where will they go? BC and Ontario. Of course, Quebec lets in a lot of refugees too…

Q: Your forecast for industrial, retail office, multi family, residential real estate was outstanding (Ozbuzz 45).

A: Thanks. It is indeed silly to ask, “what will real estate market do”. We have several markets across country and a wide variety of products, all of which will likely be affected differently.

And yet, that remains the most asked question. When will prices go up again? Well, first they have not gone down yet. Second, here it is – wait for it – wait for it, they’ll go up on September 8 at 11 PM. Ha-ha!

Q: On Michael Campbell’s CKNW you mentioned the ‘renting versus buying’ a luxury property. Where can I listen to it again?

A: Go to moneytalks.net. You can listen to all of Mike’s shows there.

Q: You are predicting older people and families to move out of town. If so, which towns are they going to and why those groups and not millennials?

A: I would think, Vancouver Island like Parksville or the Sunshine Coast as well as the Kootenays (price) etc. Millennials want to be where the action is and most of the jobs are in town. They are also less likely to drive. Tons of questions on gold silver and bitcoin. I mean tons!

Your reference to buying gold jewelry and not bullion is stupid.

- If you do not understand bitcoin – you understand nothing

- Silver and gold have had the greatest appreciation in history – ever…

- Some nasty. (deleted and blocked.) If you are a gold bug you expect trouble…and here I was even recommending gold…but jewelry obviously is not acceptable…

Ok answer:

- I do not recollect talking ‘bitcoin’ in the last 3 issues.

Yes, I have real estate engraved on my forehead. Why? Read Ozbuzz 39-43.

Can’t be any clearer…it is my hard asset of choice, it has an unquestioned history of performance, 50% of your payments go to building equity (forced savings account) but…most of all it has leverage.

- Had you invested $100,000 and paid $800 an ounce for gold in 1980 – it then floundered around under $800 an ounce for 27 years and finally got back to $800 in 2007. Since then it has doubled. Good.

Had you bought a house in Vancouver for $100,000 in 1980 it has now grown to $1.7 million. Not only that you would have paid it off in 2005 and since you likely only paid down $5,000 your return on your DP was in the 100000 percentages. Leverage!

- Having said that, I tried to say that there may be a place for gold now… But if you think the world is going to end and put your gold into a savings box at your bank and/or your house ask yourself…. Who is to say that the bank will not stop access by law to your box and someone with a gun and you without one takes your gold? Oh, and going over a border it could be confiscated – must be declared. (Remember we are talking about you: the end of the world kind of guy or girl!).

- SOOO, in that case only…(end of world) get your gold in high gold containing jewelry – easy to get over the border, do not need to declare…and you can distribute it amongst you and yours. Some of the world’s biggest countries with difficult (often treacherous) governments have seen their populace embracing gold jewelry, (India, Iran etc.etc.) That is it. So now, to the question: I am sure you own gold…No, I do not…but I still may buy some. My decision.

Q: What is it with Kimberley? You must own a lot of real estate there that you are trying to flog? I do not see any upside there for investors.

A: I currently own no real estate (other than one building lot) and not flogging any either. Ok, I see so many people in the interior renting. Yet, you can buy an older ski condo under $100,000 on the hill, (I started recommending them when they were $55,000), fully furnished and with balcony and FP. I think it would be a fine investment for a young couple with $5000 down? They should not be renting. Also, did you ever hear of skiing, golfing and river rafting, lake fishing? And then no parking meters! I love the place…yes. But the same applies to Fernie and a half dozen other hills.

Q: Stocks are up 30%. You must agree that stocks are soaring and that is where most investment money should be.

A: You know how I feel about people that start with: “You must agree…”. I must do no such thing. Apart from the fact that the market dropped 30% and more first … 4 or 5 stocks are representing 20 percent of the stock market. Program buying and selling, day trading rules and derivatives abound. Trillions. It is the last place I want to be. But I salute you if you sold on March 22 and then bought back on March 30!

Q: OK, I have cash, what and where should I buy?

A: Do not worry about cash right now. I think in mid to late 2020 the question is Not what you own but what you do not own! Read that again!

Q: You always are very bullish on all real estate. Could you be wrong?

A: Duh! Yes! Of course. I have been bullish for 45 years, but could I have been wrong – of course. Any past crisis could have resulted in a different outcome. I just believe that we will muddle through and the printed money will result in higher asset prices. I also am NOT bullish on all real estate. I am warning outright for years not to buy hotel condos, timeshare, quarter share, Phase II ski condos, etc. I also recommend that you only buy the deal of a lifetime now, until the outcome is clear. (see next question)

Q: We have had governments that acted quickly and solved the financial crisis … why not buy now everything, because inflation is surely the outcome? Your argument?

A: Yes, I think that in the long-term hard assets will go up (even Rosenberg says buy real estate). However, we may have solved a financial crisis. But that is not the issue now. We have created a solvency crisis and we are FAR FAR from having solved that one.

Q: So many bankruptcies. Companies in chapter 11. I see nothing but depression ahead.

A: Your view is important – for you. But understand this: when a company goes into chapter 11 it is re-organizing, getting rid of a lot of creditors and have a judge wipe out a lot of debt. Then it – like Phoenix from the ashes – re-emerges. That is not really a bankruptcy. Chapter 7 is going out of business for good. So, if you are worried, look at the “bankruptcy” closer: Chapter 7 or chapter 11? If they are all chapter 11 … fewer worries.

Q: You do not like California. Why?

A: I like California beaches, its cruise ship ports, driving through it … I dislike its people, its totally left attitudes. However, it is not about like or not like. Right now, you don’t want to be in high tech states. People are feeling and resenting high real estate prices, companies are relocating to Texas and Arizona in droves because cost of employees is so much better … and people will look for lifestyles.

Several comments on the big ideas… Looking at cars right now…will try ads on Twitter…stink bids…asking for a car with my condo…working on my mind. Happy you are…

Q: You keep talking “deal of a lifetime” What is that? How do I know? I am looking in the Westside of Vancouver. No deals here.

A: Well, then you cannot buy on the Westside now. A “deal of a lifetime” is well below market, usually a purchase of someone that’s in distress, or carries financing…and it is sooo good … you can’t help yourself. I salute you that you are looking. In life you do not get what you deserve, you get what you negotiate.

Q: I liked your item on behaviour and changes. You say all is good now?

A: Unfortunately, not. We are polarized more and more…we only hear what we already believe. I spend 5 minutes with someone, and I know he/she only listens to CNN and quotes well known actors. No matter who wins the election there will be blood on the streets. What happened to a democratic elected government? Yes, I believe, but only if it is on my side of the coin. What happened to loyal opposition? Only if I win will I be loyal to government and my country? We make more and more idiotic decisions under the banner of climate change, hate the left, hate the right instead of cherishing what we have… And change our views at the ballot box. The whole world wants to be here…you are here. Work within the system.

I fear, but then … the old adage: If you are not a socialist under 40 you have no heart, if you are one over 40 you have no brains. I used to understand that… Now, there is no age limit to having no brains. It has to all be “my way”. And that is scarier than the virus.

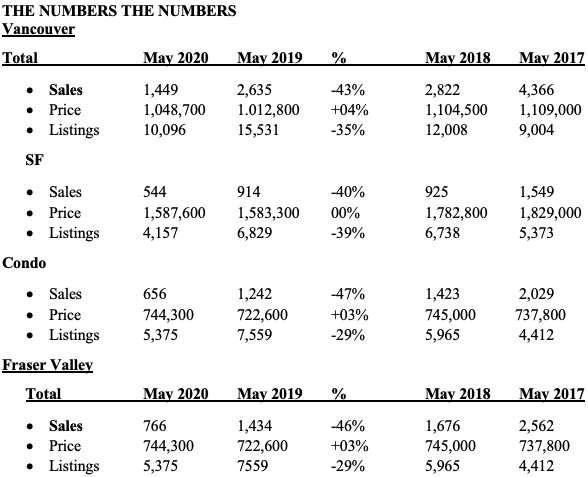

THE NUMBERS THE NUMBERS

Major Point: Yes, sales in Vancouver are down y-o-y overall (everywhere). But Note: Sales in May are higher (1,499) over April (1,122). SF sales are higher (544) versus April (393). Condo sales are higher (766) versus April (656). Prices are higher – year over year by 4%.

LIVE LIFE LARGE

The best time to make changes

In my life was five years ago

The second-best time is today!

I spend 15 minutes every day on powerful clear intentions

Focus No doubt Clarity

I state what I want with passion

I will grow into my future best

Look up all the

“Grow into your future best” cards at: www.commitperformmeasure.com

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.com at 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment