January 14, 2020

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” –John Kenneth Galbraith

2020 the Year of Plenty (of volatility – opportunity)

- HOT PROPERTIES – $389,000 HOUSE WITH 2 SUITES

- OZZIE EXPANDS HIS INFLATION VIEW – WHY ALWAYS REAL ESTATE

- PRINCIPLES

- QUESTIONS, QUESTIONS

- THE NUMBERS – HIGHER?

- MAJOR FORECAST – WHY HARD ASSETS SOAR

- GERMAN NEGATIVE RATES

- REALESTATETALKS.COM

- WORLD OUTLOOK FINANCIAL CONFERENCE MUST ATTEND

QUESTIONS, QUESTIONS

Q: The hot property in the US is pretty run down.

A: The 4-plex for $13,000? It’s totally renovated with gold fittings.

Q: At danger of incurring your wrath: “You must agree that these are different times. Your Pollyannaish view is sickening. Any thinking man can smell the collapse.”

A: I must agree to nothing. I admire your sense of smell. I also have a good smell. I smell you. I recognize your name. Similar letter in 2009?

Q: Michael Campbell talks about a financial crisis ahead. I am confused. Your view?

A: Come to the World Outlook Financial conference on Feb 7 and 8 in Vancouver. These are indeed worrying times… Clarity will come after that conference. Look it up here: https://mikesmoneytalks.ca/world-outlook-conference-2020/

Q: There are a lot of buildings that were put on hold last year. What if they came back all at once? Pressure on prices?

A: If they did, yes. Right now, though, every developer is waiting to see whether the euphoria of December will translate into 2020. In the meantime, try your offer.

Q: I tried to post in realestatetalks.com. Did not work. Is it members only?

A: If you ask, does it cost money to post, the answer is no. But you need to create an account (takes 30 seconds) with a valid email. Last month we had 67,413 visitors but only 2,600 or so members that posted.

Q: I like the tech section/words I hate/revenge of the little man…make it regular?

A: Will be back next issue.

Q: You keep referring to what you wrote in the past. I never was a subscriber. How do I find out what exactly you said?

A: Go to Youtube.com/jurockvideo … I have a ‘blast of the past’ with TV interviews back to the year 2000. You can also buy my speeches from previous years at our annual conferences (jurock.com/products)

Q: Europe is now in negative interest rates. Isn’t that a benefit for Germany? Getting 30-year money and paying back less?

A: If you think private industry or private individuals are investing their hard-earned cash with no return and in fact less capital back – I like to know what you are smoking? Banks lend each other at negative rates on overnight basis. The question should be, if you are like me – sure the money is NOT put in the bank by investors, where does it go? Well, right now to the US where you still can get a 1.6% return but next … real estate! A German real estate co put in a half a billion into an Edmonton tower, a German industrialist paid a reported $432 million for the Hyatt Center in Vancouver – there are hundreds more examples.

Where does the money go is the question! I want to go where it goes.

Q: Where Ozzie has a question: Please feedback on podcasts: Do you like the guests? The format/ The topics? Suggestions?

PRINCIPLES

It’s funny at every year’s beginning, I get peppered with “what do you think about the real estate market” and “you must agree that this year is different”. Well, dear reader, you know how I feel about the “you must agree” opener.

I have been running large corporations previously (ozziejurock.com) and writing subscriber-based forecasts for now some 40 years…nothing changes other than the zeroes on house prices (more below). People always want to know about ‘the market’. Yet no one buys ‘a market’. While North Vancouver may be strong, Surrey may not be, so how does knowing what “the market “does, help them decide? In fact, I have seen the worst deals done in good ‘markets’ and great ones in poor market. In my view there is not one real estate market, there are a hundred markets with dozens of sub-markets each having their own local influences. Yes, real estate is very much local in nature. A local market purchase investment and thus varies from area to area and product mix to product mix. BUT there are some basic principles that have held true for 50 years…

It means doing a little homework…understand yourself first (flipper, investor or shark?), review and apply principles of buying a condo or SF to each local area and understanding taxes and local bylaws to boot.

To give an example. Laneway houses are all the rage. But people don’t realize that your ‘mortgage helper’ may cost you a third of your capital gain. So, after a hefty investment to build that fine Laneway place…the pain of losing (or part) of your exemption is added.

So, long term (suffering?) subscribers notwithstanding (if you are one, you can skip this next part of WHY real estate will ALWAYS be the best option, as long as we are creating money out of thin air.

If you are not a long term (suffering) subscriber, you must read on…

So, what about this year 2020. 2020 – year of plenty? Plenty of what? Excitement, surprises, unpredictability or even volatility. Well, lets fine-tune ourselves to seeing with 20/20 and look at 2020…

Enough of that…

When you look ahead you must concern yourself with not only the unexpected but must understand and review fairly predictable principles and analyses that apply to all facets of real estate investing.

For some 26 years of writing the Jurock Real Estate Investor (JREI) newsletter… every year has been more difficult to stick to our forecasting guns. Yes, ahem, forecasting is never easy – particularly when it is about the future… and this January of 2020 is no different… as in ‘not easy’. Markets become the stories people tell about them. So, just like the last 26 years, let’s tell some of those stories from the experts and then we’ll give you our much-biased opinion.

First, let’s review the basics of what makes a viable real estate market and a thoughtful investment. So here goes – Principles that you need to evaluate – they do not change! Ever!

Macro:

- Inflation or deflation?

- Timing?

- Trend?

- Cycles?

Local:

- Inward migration?

- Job creation?

- Affordability?

- Interest rates?

- Supply and demand?

Truths:

- Before you invest, analyze who you are: Investor, Flipper, or Shark (read my story in Donald Trump’s book.

- You do not buy the market, you buy an individual property in a specific suburb,

with specific features.

- You make the most money on the day you buy.

- Markets become the stories people tell about them.

- People go where jobs grow; values grow where people go.

- Preserve and protect what you have first!

OK the real big one:

Inflation or deflation?

If you read this last year feel free to skip it. But if anything – I could name dozens of examples of constantly rising prices. Which is the inflation that matters to you as an investor. When people tell you about core, headline, etc. inflation…just forget that and look only at price, cost and hard asset price inflation. A slightly different take – and a different conclusion? No way is inflation 2% or less! Some fruit/meats etc. are up almost 40%. In fact, all fresh fruit and vegetables have soared –and not by the 3% the government agencies report. I think it is more between 10-20%! And meat? Soared! Pork was up more than 60% in 2018 and have you bought any filets lately? Up 50%. A crab is now $21, and prawns are $24 per pound – up 40% as well. People living in northern and remote communities are paying even more.

Food prices in fact have been rising for 5 years. It is crazy to say they are up only 3% in one year. But if we believe our government, inflation is still below 2%, which anyone who goes shopping knows is utter nonsense. We have health care cost inflation, drug price inflation, personal expenditures of all sorts are rising dramatically, new taxes up like crazy, as are all government services – all of it is – in my view – cost price inflation! Go to your favorite restaurant…everything is up 50-80% in 5 years. Dear Reader, price inflation is here and has always been here. JREI has argued this (in writing and at every speech) since 1993.

Clearly, inflation – while not perfect –would be the preferred scenario (as it has been for 40+ years). We at JREI believe that this has always been the outcome of printing/creating money and that it will always be – however it keeps coming back with more dips, valleys and peaks. There are of course many definitions of inflation. Government economists will tell you that inflation is an increase in the general price level within an economy. However, we are with Milton Friedman who argued the opposite: “Inflation is the result of an increase in the quantity of money and debt within an economy. Inflation is primarily a monetary phenomenon.” Quantity of money and debt! We have massive personal and corporate debt…We print massive amounts of money worldwide…and 2% inflation is the outcome? Hogwash.

The only question that is at issue is “what kind of inflation is it?” Governments talk core, headline and other esoteric types of inflation. Some say price inflation is not real inflation (until you pay higher and higher prices!). JREI talks primarily of hard asset price inflation. At any polite intelligent company, you can have debates over this all night. Add to this the argument that either deflation (bust) and inflation (boom) will be the outcome –you could get ulcers. Well, sit down…We say that – fact is – we have both!

I argued at an appraisal conference in 2004 or 2005 that we have an industry by industry deflation/depression and an industry by industry inflation/boom …

AT THE SAME TIME!

Also – we argued that as technology cycles go faster and faster, our ability to produce things faster and cheaper increases and so you can indeed have boom and bust at the same time.

Let me explain: If Jack was a vinyl record producer 20 years ago, he was part of an $11 billion-dollar industry, and he was in a boom. Along came Joe who opened a CD company and 5 years later he grew it into his boom. Jack went bust. Fast forward another 5 years and Hannelore has opened a DVD shop, grew it into her boom and now Joe has gone into a bust at the same time. Video stores? Online downloading? Boom– Bust. Industry by industry depression and boom – bust… often – at least for awhile – at the same time.

You must understand this if you want to get to my conclusion that today’s world – as crazy as it is – will still have hard assets rise, no matter what the official rate of inflation is.

But Ozzie say some people: “What about commodities? Aren’t they in a deflation/depression?” Well again – Both.

It is economics that drive commodity prices, not the other way around. Commodity prices are falling because of our economy’s weakness in each sector. Something is wrong here GLOBALLY; it is not a supply issue. The US drives the world economy with productivity, a strong currency and vision? Canada deflates, lags productivity depends on natural resources. An economy that has poor productivity and too much reliance on what’s in the ground has problems if China and others stop buying its commodities.

Okay, agreed there is commodity price deflation? I agree it WAS here, but at the same time we are in an inflation/boom in real estate and other hard assets. Here is the key: AT THE SAME TIME! (Just review real estate prices 2011 – 2017 uuup and commodity prices at the same time…doooown.

Hard assets… real estate, art works and Rolls Royce – all luxury cars– things that keep their value with depreciating money (overprinting) rise. At the same time!

So maybe an industry by industry deflation/inflation, maybe a core headline basket/ hard asset inflation at the same time.

But, no matter what, it remains my view that we will have a predictable outcome eventually: Inflation in hard assets. We have done so for 50 years! Since 1993,we at JREI (and myself personally for 44 years of real estate investing) have stayed the course, believing in the inherent value of real estate first and always believing in hard asset inflation being the eventual victor and real estate remaining a great wealth builder in the long run… and often (timing!) in the short run as well.

In our JREI newsletter we have covered currency/stock/real estate/country/political/business/interest problems galore. You name it … we experienced it, we talked about it. It wasn’t just the last couple of years and the coming year of 2020 that began with an astounding lack of clarity. If you look back … in fact, we often faced downright scary headlines in the past. Uncertainty permeated everywhere. And yet, through all those previous dark years of ‘eyebrow raising’ bad news, the continuous overprinting/over creating of money saw us muddle through – albeit with ever higher prices of hard assets.

AS LAST YEAR – NOW THIS IS IMPORTANT:

While we at JREI believe firmly in higher inflation in asset prices, we also see our job as having to look at all eventualities. In fact, my job and yours is to guard against all…

“LOW PROBABLITY BUT HIGH IMPACT (BLACK SWAN) RISKS”.

It is easy to distinguish between high risk and low risk, but what if a low risk (if it occurred) would have a very large impact?

Deflation and a resulting depression (low, low probability) would indeed be a Black Swan of an unimaginable magnitude and as we write this there are clear signs in Europe of falling prices, negative interest rates and crashing currencies worldwide.

This is why we recommended in 2016 to keep some powder dry (30-50%). Some cash waiting for the outcome may be a good thing in 2020 as well. Good time to wait it out. Not because we are scared, but because we are once again into unchartered waters.

Clearly – and this is important – if you believe that we are going into a deep dark depression you must get out of all real estate, pay off your debts and go hide somewhere – with your gold bar between your teeth and dried food on your back. I first wrote this in 2009 when gold was $1,800, repeated it in 2012 when it was priced at $1,650. Today? Still only $1,500. Your real estate in Vancouver? Up 70% (!) at the same time. The doomers that preach depression and want you to sell your home to buy a pile of gold may think that it will help them survive. They do not consider that the trucks with your food may not run to the supermarket, that there will be no gas at the pump and people with guns will come and hit you over the head for your gold. A depression in our advanced information society is not something anyone should wish for. No docile masses of the thirties standing in breadlines would be in this ‘depression scenario’.

Of course, dear reader, you know where we stand. While the deflationary scenario is always possible, we do not believe it is likely. It is far more palatable for a government to repay its debts with a depreciating currency than making the tough decision of raising rates, reigning in expenditures and paying down debt.

Our multi-year position is that excessive money creation always results in higher inflation of asset prices after a period of wringing out the excesses created through easy money. Period. We have seen the latter scenario unfold for some 50 years… ever higher money supplies, ever higher government deficits resulting in ever higher prices. Eventually (2 years – 5 years?) inflation won out – every time! However, while we go through the excesses (created years before) it feels worse. Whether it was 1974, 1981, 1987, 1992, 1998, 2001, 2008 or 2017/2018 each time the specter of deflation is raised, collapses and depression is talked about and fear grabs us by the throat.

Every time!

Well, it actually IS worse! It is more money, more zeroes, it feels worse. Usually there is wealth destruction in development, in the stock markets. Nothing unusual about that. We have written more on this subject than in our 26 years, because we have seen – no matter the dark forecasts, no matter the 67 books that espoused and predicted the collapse, deflations and depressions since 1974 … inflation came out the winner. I wrote my book Forget About Location, Location, Location in 1998 in the middle of a sharp downturn of real estate values. In it I forecast that if we printed money for the next 35 years (and we are printing more than ever!), as we had for the 35 years preceding 1998, every house in Vancouver would be $6 million or so at the end of it. (The average price at the time was $278,000!) We also wrote then that every house would be over $1 million in 10 years. It took 12 years! In 2017 the average price on the Westside clocked in (at its high) at $4.3 million!

Still doubting?

Major Point: Governments – and anyone badly in debt – benefit much more from inflation than deflation, so every effort will be made to avert the latter. In 2020, the trouble may be that governments (around the world, yes, Europe too) have set in motion an inflationary campaign of such magnitude to avoid deflation that it can so easily lead to a fiasco of super or hyperinflation. Like in 2009, we must be very vigilant in 2020 and indeed the next few years. As we stated … the no.1 thing to do in 2020 – we must preserve what we have.

We still believe that higher hard asset prices will be the outcome eventually. But – taking some (real estate) chips off the table may be prudent. (For the detail oriented: Look up John Williams Shadow Statistics – shadowstats.com –that show what, in his and our view, the real inflation rate is like.)

My dear patient reader… this was long. Thanks for hanging in there…and please debate this with me, if you disagree or support if you do. My other principles…must be left for the next few issues. All make me believe however, as I said before, the market may well be in a bottoming phase…huge creation of money, huge foreign investment, spectacular immigration (over 210,000 in third quarter), easy money and a US election year…all conspire to produce MORE inflation.

TIMING: Good. Market bottom close – watch for Feb/March numbers and remember “You make the most money on the day you buy.”

TREND: Good, huge inward migration, huge investment, huge new jobs (Amazon etc.) Shopping online, people moving back to the city…etc. people moving where the jobs are.

CYCLE: Stagnant. Still need to clear out inventory. Many developers sitting on sidelines with huge inventory. Waiting for confirmation. Good time to make stink bids (get extra parking, a new car(yes) etc.). Close to restarting.

Next issue: Timing redux

US REAL ESTATE MARKET – Snapshot

The seasonally adjusted annual rate stood at 5.35 million in November. Sales are up 3% from a year ago. Lawrence Yun, NAR’s chief economist:” markets remain strong … with more than 2 million job gains in the past year. “The median existing-home price for all housing types was $271,300, up 5.4% from November 2018 ($257,400), as prices rose in all regions. November’s price increase marks 93 straight months of year-over-year gains.

Total housing inventory at the end of November totaled 1.64 million units, down approximately 7.3% from October and 5.7% from one year ago (1.74 million).

Unsold inventory sits at a 3.7-month supply down from the 4.0-month figure recorded in November 2018. Unsold inventory totals have declined for five consecutive months, constraining home sales.

Compared to one year ago, fewer homes were sold below $250,000; with a 16% decline for homes priced below $100,000 and a 4% reduction for homes priced from $100,000 to below $250,000.

Our recommended markets (since 2011) have been soaring in value. (Phoenix, Houston, Dallas, Portland and Seattle). In fact, after we recommend Phoenix 1st in 2011 IT STILL IS THE BEST BUY! On 12/18/19 Yahoo Finance crowned the Phoenix real estate market as the HOTTEST real estate market it in the US! (We already knew that.) The basis for the declaration was 2019 appreciation nearly 3x’s greater than the national average. Phoenix rents increased 6.8% year over year, more than double the national average. For the third straight year Maricopa County lead the nation in population growth, by nearly double, and lead the nation in US migration.

CANADA SNAPSHOT

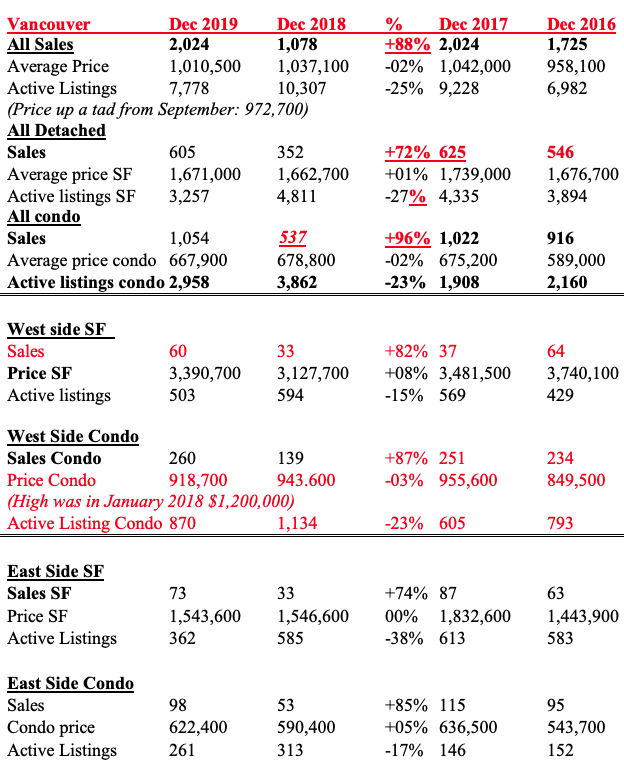

Bloomberg quotes: “Real estate experts are calling it a comeback year.” Certainly, the numbers for Vancouver below (actually as we reported since July 2019) show an astounding strong comeback is underway in the Lower Mainland! Sales up 74% to 96%, prices on the westside single family home up 8% etc. Toronto home sales jumped 17 per cent in 2019 over the previous year and prices rose four per cent y-o-y. The average selling price in December 2019 was $837,788 – up almost 12 per cent year-over-year. Ottawa saw sales jump 7 per cent in 2019 and prices up 9 per cent. The Quebec Professional Association of Real Estate Brokers reported a 26-per-cent increase in sales with condominium sales jumping 32 per cent last month when 1,301 homes were sold, while single-family home sales climbed 22 per cent with 1,808 transactions. Prices in Montreal climbed across all property types in December. The median price of single-family homes rose nine per cent year-over-year to $355,000, while condominium rose five per cent to $285,000 compared to December of last year.

Calgary and Edmonton as well as Saskatoon, all report higher prices (Not Regina) …closing out the year strongly right across North America … naysayers be darned!

Major Point: Eye opener this month?

Sales across the board UP 88%. Westside SF home price recovering +8%, East Side SF and condo sales up! East Side condo price up 5%.

As we said last month: The overall SF market has strengthened since mid June. December total sales were up a whopping 88%. Listings are down by 25%.

I report sales for last 4 years – look at them…only 2017 had (some) slightly better numbers. Not just a flash in the pan. The next 2 months (Feb/ March) bear close watching.

Condo sales overall are higher by a rocking 50% while still lower than 2017, up over 2016. But East side condos still lagging December 2017 and 2016! We said that “…we are gearing up to surpass 2017…once we do…back to normal in October?” Yes, we did!

Remember, we are reporting Vancouver board numbers. Very few new condos (sold by developer) are in the stats … skews averages. Still need to watch…not “THE MARKET”, but YOUR subarea, your suburb your town and your product…and most of all yourself!

Are you looking to invest and hold for cashflow, flip or steal in a foreclosure? All take a different personality and different actions by you! Never mind “the market”. Maybe it’s turning overall (and it is), but not in your sector, suburb, etc.

Still, again it is a mad world, negative interest rates, slowing global growth, trade wars and great geopolitical risks.

I said for a year: People and money are on the move worldwide looking for safety…and you have not seen anything yet. The 3rd quarter number we reported last time (38) is mind boggling!

The bet? Higher prices ahead again. Best deals? Buy new condos, make lowball offers…

EYEBROW RAISER:

Warren Buffet has $128 billion in cash (January 18). Huh?

HOT PROPERTIES

- Guildford, Surrey – 7-bedroom home, 3 bathrooms, 2 kitchens. Great rental income $3,500. Price $799,000

- Edmonton, House with 2 suites, full permits, fully legal. Cashflow $465 per month

Fully renovated, all new components throughout. Price $389,000

BOOK OF THE WEEK

Ace Victoria Realtor Rick Hoogendoorn sent this book recommendation. I concur: Mini Habits by Steven Guise

Ace Victoria Realtor Rick Hoogendoorn sent this book recommendation. I concur: Mini Habits by Steven Guise

Lasting Change for Early Quitters, Burnouts, the Unmotivated, and Everyone Else Too

Watch this short video explaining this great book: https://www.youtube.com/watch?v=rETOlen9G30

OZZIE SONGS OF THE WEEK

Some German bands:

Wolfheim – Kein zurueck (no way back) https://www.youtube.com/watch?v=icUC32-0WuY

Eisbrecher – Vergissmeinnicht (don’t forget me, forgive me) https://www.youtube.com/watch?v=hmbQEdUivRM

Rammstein – Du hast (warning – Heavy Metal) https://www.youtube.com/watch?v=W3q8Od5qJio

LIVE LIFE LARGE

Everything is in personal relationships

A great life is shared with

personal and professional pillarsI am attracted to people

that share my values

I am attracted to people that

Value family

Community and country

I attract positive relationships

I will grow into my future best

Look up all the

“Grow into your future best” cards at: www.commitperformmeasure.com

HOLIDAY SPECIAL

Listen to Ozzie Jurock’s 25 Money Making Principles in the comfort of your home or car, as well as his two books, ‘Real Estate Action 2.0’ & ‘What, Where, When & How to buy Real Estate in Canada’ – now available on USB!

Choose from one of our three great holiday specials

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

Ozzie is on air with Michael Campbell on the fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The radio station is CKNW and the best way to listen to it is WHEREEVER YOU ARE IN THE WORLD, just visit www.cknw.comat 8:30 am every Saturday (PST), click on live and you’re good to go. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

Why subscribe if I can just go to the website at Ozbuzz.ca? Hot properties and the latest podcasts are DISTRIBUTED TO SUBSCRIBERS FIRST– posted 2 weeks later on website.

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment