“Only dull people are brilliant at breakfast.”

THE JUROCK REAL ESTATE INSIDER CONFERENCE IS A MONTH AWAY (REOUTLOOK.CA).

NOW IS THE TIME TO BECOME A SPONSOR (SEE BELOW).

THANK YOU FOR THE HUGE RESPONSE TO OUR BC DAY SALE.

Most desired ticket? The VIP!

OZ BUZZ MOVER AND SHAKER PODCAST – Ace recreational land entrepreneur, developer, appraiser. A real BC trailblazer: Rudy Nielsen, RI, FRI, President and Founder, Niho.com. One of the foremost experts in recreational land valuation and development in British Columbia. With over 50 years of experience, Rudy Nielsen is a highly regarded expert in the real estate industry. Rudy has occupied the roles of developer, appraiser, entrepreneur, land owner, real estate consultant, speaker and deal maker. See ozbuzz.ca for more Ozzie Jurock columns and interviews.

OZ BUZZ MOVER AND SHAKER PODCAST – Ace recreational land entrepreneur, developer, appraiser. A real BC trailblazer: Rudy Nielsen, RI, FRI, President and Founder, Niho.com. One of the foremost experts in recreational land valuation and development in British Columbia. With over 50 years of experience, Rudy Nielsen is a highly regarded expert in the real estate industry. Rudy has occupied the roles of developer, appraiser, entrepreneur, land owner, real estate consultant, speaker and deal maker. See ozbuzz.ca for more Ozzie Jurock columns and interviews.

Listen to the Podcast

Today’s Issue:

- OUTLOOK CONFERENCE – COMING UP FAST

- THE NUMBERS, THE NUMBERS

- WHAT EXACTLY ARE NEGATIVE INTEREST RATES

- A NEGATIVE MORTAGE RATE, HUH?

- GREAT HOT PROPERTIES 5 PLEX $85,000 INCOME

- QUESTIONS, QUESTIONS

QUESTIONS, QUESTIONS

Q: US prices are really coming down. Here in Oregon new construction is way off and sales overall are down. Prices will follow down too.

A: I don’t know where you get your numbers. I recommended Portland as a great investment – low average prices, strong economy, etc. in 2013 – 2017 in my newsletter. I have no specific numbers at hand for 2019. I DO know this: Total U.S. Homeowner Equity hit a record $15.8 trillion in 2019. Homeowners enjoy a $9.7 trillion gain in equity in the last 10 years, up from $6.1 trillion in Q1 of 2009. That is huge and against a backdrop of bad news from 2009 – 2012. In my view – now that the world is going into a zero-interest environment…all hard asset prices are bound to rise (continuing the relentless 55-year climb.

Q: DOUG PORTER FROM THE BANK OF MONTEAL SAID THAT WE WILL HAVE A RUNAWAY INFLATION? YOU AGREE?

A: I saw that he said something like that: “If rates go down to zero there ‘is a risk’ of surging house prices.” I love this actually. We are talking Bank of Montreal here. Looks like (some) mainstream economists are coming over to the ‘dark’ (Ozzie) side and predict inflation!!

Q: YOU SEEM TO BE THE ONLY ONE REPORTING A RESURGENCE IN REAL ESTATE MARKETS.

A: Nope. CMHC says this month: “Vancouver housing is no longer a risk’. Canadian Real Estate Associationsays sales are up 7% and prices ARE UP across Canada by 4% in July. All major cities turned in July.

Q: I have heard you make the ‘just look back’ argument over the years. I know it and believe it now. I have done it and have studied it. But it was good to hear it again. I know this drives you crazy – but, will we recover this time? Hehe.

A: In the last issue I did indeed ‘look back’ over the ever increasing higher and higher prices thru all economic trials since the1960s. Really can’t add much to what I said last month and today elsewhere. Just remember, the forecast to go from $278,000 (In 1998) to over $2 million in 2018…was much harder to make and even harder to believe!

NEGATIVE INTEREST RATES

A number of questions and comments on the negative rates quote ($14 trillion debt now at below zero rates).

Q: The questions I’ll answer are 1) “How do negative rates work. I mean how exactly? And 2) “I don’t understand it. How could they possibly attract capital?”

A:

- The new world we are entering is not ‘profit ON’ or EVEN just ‘return of capital’. Negative interest rates take it a step further. Safety must be paid for! You get back less than you put in! In Germany the 10-year bond is .07% negative this week. Put a million in the bank get back every year $993,000. Now add these 10 times (calculate reducing balance) and you get the idea!

- My German banker school friend put it this way: ‘You put gold in the bank for safety, you pay for storage. Negative rates are the same thing. Hmmm!

This is a crazy world where you can attract capital simply for safety – not return. The world is awash in cash. And we haven’t seen anything yet!

EYEBROW RAISER!

1. A 20-year mortgage in Denmark carries NO interest. Listen to this: A 10-year mortgage carries negative interest. Take a million loan, pay back only $922,000 (or so). Huh?

2. Long time Michael Campbell friend – Martin Armstrong predicted in July that “Either Epstein will be found dead claiming suicide because he had remorse, or he will make a deal and then probably will be found dead of some heart attack afterward. I would be shocked if there would EVER be a public trial allowed.” Food or BIG thoughts!?

HONG KONG RIOT QUESTIONS

We covered it last issue. Yes, it will help add buyers into our market. But how many and by when is anyone’s guess.

MORE OPINION?

Euro will hit eu 1.05 by October

Canadian dollar will drop by October

Ozzie will make a most astounding prediction at OUTLOOK 2019

The US will issue a 100- or 150-year bond rolling all its debt into it…and trying to clean

up the balance sheet that way. With the world awash in cash it will work. That will be inflationary.

Don’t buy retail, department stores, shopping centres— hard assets and stocks

Keep some cash…the older the more. For exact suggestions go to Ozbuzz 9.

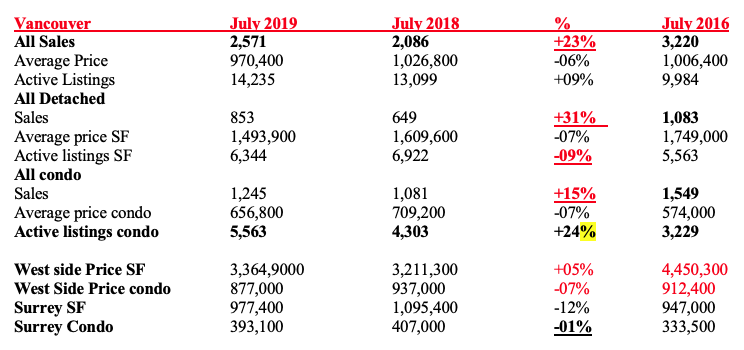

THE NUMBERS, THE NUMBERS

A hot July? From right across the country buyers came out in the summer. Darn the buns in the sand, the toes in the water – WE WANT REAL ESTATE!

Toronto sales were up 24%, Montreal and Ottawa 15%, Calgary up 8%, Edmonton up 12%. (Edmonton SF home unit sales increased 18%.) And Vancouver? UP 23%! July was much better than last year’s July but NOTE: an even better month than June – that is usually reversed. So, is a bottom in place?

Surprises?

- Single family home sales are ‘soaring’: Up in Toronto, up 18% in Edmonton and up 31% in Vancouver. Vancouver SF listings DOWN 9 %.

- Overall prices in Vancouver down 6%. That’s not that much.

- Condo markets are up 15%, listing in better shape than last year. There is a persistent rumour that banks this fall may put pressure on some developers. Our view? Take out 5,000 units (that are not built) will put pressure on availability of condos and eventually…higher prices again.

OK at the luxury end, markets are still very soft…but we don’t live in luxury sales. Westside highs:

- January 2018 average for a westside condo was Price : $1,072,000

- September Westside house, Price: $4,466,700

- The overall SFG market has strengthened… the fringes of high-end condos and houses are slowly getting to the point of (some) sanity. We hear of Chinese buyers in West Van making stink bids, etc.

Major Point: Ok, what do I do, what does it all mean?

It is a mad world, negative interest rates, slowing global growth, trade wars and great geopolitical risks – Iran sanctions: Brexit, Turkey, Greece, nutty Italy and now violent protests in Hong Kong. Narrowing bond spreads, inverted yield curves, recession?

If that is not enough, the US Fed is getting ready to come to the market to fund its $1 trillion ($1 trillion!!!) fiscal debt soon.

We do not have a crystal ball, but in my world and my 50 year experience…that means one thing: The world combined will be creating money, (QE, negative rates). They will lower their currencies in a beggar thy neighbour effort to become more competitive…and, wait for it…wait for it…real hard asset prices will rise! Period!

However, we may have to go thru the volatility, the uncertainties and the confusing government restrictions first before we can resume the upwards ride. But if not this year – then next…but it’s the availability of cheap money that will drive us higher again eventually.

HOT PROPERTIES

- Horseshoe Bay – (Surrey high rise prices for West Van Waterfront! 2 Bedroom + Family Room 1,900 Sq. Ft. Home built by a world-class developer. Concrete construction, 10ft ceilings: $900 a foot.

- Victoria, 8-unit office building on Vancouver Island with a 6-cap rate! Triple net commercial

Close to the new hospital site in a growing area of the Cowichan Valley. List price $3.7 million - Vancouver: 5-Plex on a double duplex lot. Price: $2.3 million. Cashflows: $85k a year.

BOOK OF THE WEEK

Golden Oldie…but goodie!

Golden Oldie…but goodie!

Al Ries & Jack Trout: Horse Sense. The key to success is a horse to ride! Manypeople assume that success in life involves “trying harder”. Nothing is further from the truth. The most successful people are those who “find a horse to ride”: the one idea, the one company, the one thing, or even the one person that can propel them to the top. How to go about finding the “horse”.

SONGS OF THE WEEK

- Qntal – Entre moi et mon amin https://www.youtube.com/watch?v=D_Yc5SQ-ROk

- Over the Rhine – Let’s spend the day in bed https://www.youtube.com/watch?v=4u39ajGLivQ

- Meat Loaf: I do anything for love – but I won’t do that https://www.youtube.com/watch?v=YyU44qozXyk

AUDIOBOOK – LOOK UP PROMO CODE

NEW: You can buy both of Ozzie’s books and Ozzie’s 25 Money Making Principles on USB and the complete Land Rush audio on USB by ordering them here https://jurock.com/products/

WANT TO PARTICIPATE?

Go to www.realestatetalks.com – Some 2,500 members (47,009 posts) talk real estate. Ozzie created this bulletin board in 1998!

If you are in a real estate related industry of any sort (realtor, appraiser, lawyer, home inspector, etc.) list yourself in Ozzie’s free British Columbia real estate directory at www.bcred.ca.

OZZIE’S YOUTUBE CHANNEL

You can watch all videos and podcasts on my YouTube channel at https://www.youtube.com/jurockvideo. It is a great way to check on what I said 10 years ago.

RADIO

On air with Michael Campbell on fabulous MONEYTALKS every Saturday sometime between 8:30AM – 10 AM. The Hot Property that we discuss there, is available by subscribing to the Oz Buzz Dispatch at Jurock.com

OZBUZZ.CA

HAVE A QUESTION OR COMMENT?

You can reach me at info@ozbuzz.ca with all of your questions, comments and concerns regarding the Oz Buzz publication.

LIVE LIFE LARGE

Whether you have watched “The Secret” or believe in “The universal laws” …we always create internally first…

So, watch what you think about!

Look up all of my “Grow into your future best” cards at: www.commitperformmeasure.com

Sponsorship Information

Ozzie Jurock’s Real Estate “Outlook 2020” Conference

· Proven success in the previous 27 years of SOLD OUT Real Estate Conferences

· This is the year to expect MAXIMUM ATTENDANCE

· An ENTIRE Audience of Real Estate Investors!

This year we are introducing – apart from the limited speaker sponsorship offerings – two new sponsorship packages – all tailormade to give you maximum exposure for your products and services. Depending on the extent to which you might consider to be involved as a sponsor, we have created a Double Booth and a Single Booth package.

Over 500 qualified, paying attendees, EVERY YEAR FOR 25 YEARS!

Do you have a product or service of interest to an audience of Real Estate Investors?

Get their attention! Sponsor a display booth!

By sponsoring a booth, you are part of the excitement…Profitable excitement!

**Special Event Marketing is one of the most powerful sales tools ever created. It works!

No waste, no time lags, no wondering whether you’re really targeting and reaching the right clientele.

By participating in ‘Real Estate Outlook 2020’, you know exactly what you’re getting. You meet your prospective clients face-to-face; literally. People who attend our seminars want to be there, they’re paying to be there,and they have a vested interest to get the maximum amount of information they can access. By being right there with them, you can give them this extra information, if you can give them the solutions, they will want to deal with you.

As a target audience, they’re solid.

THEY ARE REAL ESTATE INVESTORS!

All the more reason you and your company should consider to be represented visibly at the ‘Real Estate Outlook 2020’ as a sponsor.

Quality exposure to Quality Prospects – Real Estate Investors.

Here is your company’s chance to promote and showcase your products and services.

- Spectacular Venue located in the heart of downtown Vancouver

- Sponsorship opportunities available so you could get in on the action!

- All sponsors booked will be extensively advertised to the Ozzie Jurock extensive 6,000 person dispatch list as well as featured on Ozbuzz (22,000 subscribers) www.jurock.com, www.reag.ca, www.bcred.ca, www.realestatetalks.com, www.askanexpert.ca, www.ozziejurock.com.

- Further exposureto over 24,000 social media followers.

- The conference will also likely be talked about on the radio as well as in a number of other publications and media

Email Max Jurock direct at max@jurock.com or call 604-683-1111 and see how you can benefit from This PROVEN success venue

Oz Buzz Podcast

Disclaimer

Subscribe

| Subscribe to Oz Buzz: |

(You’ll get Oz Buzz 2 weeks before it’s posted online)

Leave A Comment